Welcome to iGrow News, Your Source for the World of Indoor Vertical Farming

Why Lettuce Greenhouse Sector's Growth Is Focused In The U.S.

Greenhouses for lettuce and leafy greens are being built at a rapid pace across the U.S. In contrast, in neighboring Mexico there is no similar greenhouse production and in Canada there is very little — the primary exception being 11-acre Whole Leaf Farms located in Coaldale, Alberta.

By Peter Tasgal

August 10, 2021

Greenhouses for lettuce and leafy greens are being built at a rapid pace across the U.S. In contrast, in neighboring Mexico there is no similar greenhouse production and in Canada there is very little — the primary exception being 11-acre Whole Leaf Farms located in Coaldale, Alberta.

Based on my research, the primary driver for this U.S. phenomenon is investor comfort in making U.S.-based investments in leafy greens greenhouses, which are more expensive to build compared to tomato, cucumber and pepper greenhouses.

For example, AppHarvest’s latest tomato greenhouse is expected to be 63 acres and valued at $139 million — just over $50 per square foot. In contrast, Bright Farms’ 280,000-square-foot leafy greens greenhouse in North Carolina cost $21 million, or $75 per square foot. Gotham Greens built a 100,000-square-foot leafy greens greenhouse in Providence, Rhode Island, that cost $12.2 million, or $122 per square foot.

In addition to investor interest in the U.S. market, other potential factors affecting this phenomenon include:

Temperature variance;

Pricing certainty;

Equilibrium capital leading the charge; and

Generational knowledge in Canada.

Temperature variance

Lettuce and leafy greens perform best at cooler temperatures, up to 70 degrees Fahrenheit. Tomatoes, cucumbers and peppers, in comparison, grow best at temperatures in excess of 70 degrees Fahrenheit.

As the U.S. has a more moderate climate than either Canada or Mexico, a band of greenhouses across the U.S. takes advantage of the more temperate climate. Historically, leafy greens greenhouses have been built in the middle and upper sections of the U.S. However, boundaries have moved. Revol Greens, for example, has a 10-acre greenhouse in Minnesota and is expected to build a 20-acre greenhouse in Austin, Texas, to be completed in 2022.

Historically it has been more costly to keep a greenhouse cool rather than to heat it. However, alternative sources of energy and energy pricing incentives in parts of the southern U.S. have made it increasingly cost competitive to build greenhouses in this area.

Pricing certainty

The cost to build a leafy greens greenhouse is more than a tomato, pepper or cucumber greenhouse on a per square foot basis and on a per pound basis. As a reference, the cost of AppHarvest’s tomato greenhouse is approximately $3 per one year’s production of pounds of tomatoes. In comparison, Bright Farms’ recent leafy greens greenhouse is over $10 per one year’s production of pounds of lettuce and leafy greens.

This large cost structure variance requires greenhouse-grown lettuce to be priced at a premium. In contrast, greenhouse-grown tomatoes can and are priced directly with field-grown tomatoes. In the U.S. today, greenhouse-grown tomatoes make up the majority of fresh tomato sales.

The risk for an investor in a premium product is demand fluctuation. Economic and other market conditions will have a greater effect on premium product demand compared to product with more commodity-like traits.

Equilibrium Capital leading the charge

Equilibrium Capital is a leading investor in the North American controlled environment agriculture sector. It closed its second fund (CEFF II) this past month, with a capacity of $1.022 billion. Its first fund, CEFF I, had a capacity of $336 million. Recent investments made by Equilibrium include:

AppHarvest: $91 million non-dilutive investment to support the building of its second tomato greenhouse in Kentucky.

FINKA: Expansion capital for the Mexican greenhouse company, which operates tomato, pepper and cucumber greenhouses, the product of which is primarily sold into the U.S. and Canada. This was Equilibrium’s first investment outside of the U.S.

Little Leaf Farms: $90 million of debt and equity financing for the company, which is currently building a lettuce and leafy greens facility in Pennsylvania and is expected to follow with a facility in North Carolina.

Revol Greens: $110 million of debt and equity capital to support its building of a large lettuce and leafy greens greenhouse in Texas.

FINKA is Equilibrium’s only investment outside of the U.S. to-date.

Generational knowledge in Canada

According to the Ontario Greenhouse Vegetable Growers’ website, the organization formed in 1967 has “220 members who grow greenhouse tomatoes, cucumbers and peppers on over 3,000 acres.”

Two of the largest growers in Canada, Mastronardi Produce and Mucci Farms, have invested primarily in building their current greenhouses. To the extent each has branched out, it has been primarily to berries and eggplants. Mastronardi and Mucci have little to no owned lettuce and leafy greens production across North America.

Of note, in 2019 AppHarvest entered into a Purchase and Marketing Agreement with Mastronardi, under which “Mastronardi will be the sole and exclusive marketer and distributor of all tomatoes, cucumbers, peppers, berries and leafy greens” at its Morehead, Ky., facility (currently producing only tomatoes).

Per the 10-year agreement, Mastronardi has a right of first refusal for any additional facilities established in Kentucky or West Virginia. The take-away is Mastronardi is willing to distribute and market greenhouse-grown leafy greens, venturing a reputational risk, but has not yet chosen the investment risk of operating its own greenhouses.

Speaking to the OGVG, most greenhouse operators in Ontario have chosen to put their resources into products they already know. When asked specifically about lettuce and leafy greens, OGVG said the cost to build this type of greenhouse is very expensive per unit of output.

Recap

Some of the most seasoned greenhouse operators in North America are growing a range of produce types in the Ontario, Canada, area largely focused on tomatoes, cucumbers and peppers.

Each of these products grows best at higher temperatures than lettuce and leafy greens. Canadian operators who have been in the business for generations are potentially willing to distribute and market leafy greens, yet they have not been willing to make significant investments in the area.

While leafy greens were once only grown in the Northern parts of the U.S., Revol Greens, backed by Equilibrium Capital, is building one of the largest greenhouses in Texas. Equilibrium Capital, the “smart money,” has only invested in U.S. CEA companies to-date. The exception is FINKA, which operates in Mexico but sells exclusively to the U.S. and Canada.

Based on my research, until lettuce and leafy greens greenhouse production can be priced competitively with field-grown product, it will continue to be a U.S. phenomenon. At least until that time, Canadian and Mexican operators will leave greenhouse lettuce and leafy greens production to U.S. operators.

Peter Tasgal is a Boston-area food agriculture consultant focused on controlled environment agriculture.

AeroFarms' David Rosenberg Discusses Growth, Investment, and More

From diving into publicly traded waters and launching a rebrand to introducing several new items and opening a research and development (R&D) hub, it’s safe to say that AeroFarms has come farther than CEO and Co-Founder David Rosenberg envisioned since the beginning days of 2004.

By Melissa De Leon Chavez

July 29, 2021

NEWARK, NJ - From diving into publicly traded waters and launching a rebrand to introducing several new items and opening a research and development (R&D) hub, it’s safe to say that AeroFarms has come farther than CEO and Co-Founder David Rosenberg envisioned since the beginning days of 2004.

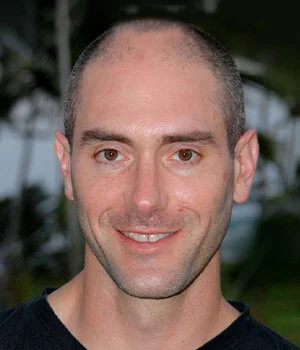

David Rosenberg, Co-Founder and Chief Executive Officer, AeroFarms

“When I co-founded the company, I thought of this as a supply chain play. I looked at the inefficiencies and thought, if we could enable local food production at scale, we could disintermediate parts of the supply chain and enable local food production and access to fresh food, starting with leafy greens,” David shares with me.

Fast-forward to today, and AeroFarms is consistently breaking ground, physically and conventionally, in the U.S. and overseas.

“Our new AeroFarms AgX project in Abu Dhabi is two-fold. One, we expect to have a strong presence in the Middle East. Two, it aligns with our value proposition where there's not much farmland. There's not as much fresh water and there's relatively low-cost, abundant energy. Additionally, we're using our presence there to really innovate. We're building the world’s largest indoor vertical farming R&D facility of its kind that is going to have a tremendous amount of innovation in it, from genetics to automation exploration,” he tells me. “We're also doing a lot in the U.S. We just opened a building expansion here in Newark where we have our global headquarters. That's another 25,000-square-foot facility for prototyping and R&D, so we have much going on Stateside as well.”

AeroFarms has revealed several advancements, from diving into publicly traded waters and launching a rebrand to introducing several new items and opening a new research and development (R&D) hub

AeroFarms has a diverse, partner-fueled style that can be seen blueprinted in David's own background. Far from a straight line to agriculture, the executive was drawn to the produce industry by a love of problem-solving.

“My last company was a nanotech company in construction, which focused specifically on waterproofing and corrosion inhibition. From that I learned how much water goes to agriculture and thought I could make a difference. I love when there could be technological solutions to existing issues, and it’s a pattern I have found across industries,” David imparts.

With a background as a multi-business serial entrepreneur from Columbia Business School, it’s no wonder that David and his team have an unorthodox approach to indoor ag, employing several outside minds to expand laterally and vertically the possibilities of the industry.

“What surprised me is that fully controlled agriculture enables us to understand and give a plant exactly what it wants, when it wants, and how it wants it. As a consequence, we're competing on taste and texture in unique ways. So, I used to think our competitive advantage was local and fresh when, it turns out, we have unique tastes that allow us to go further and distinguish us from any other grower out there,” the CEO and Co-Founder muses.

AeroFarms most recently expanded its leafy greens product assortment for both baby leafy greens and microgreens as it seeks to redefine indoor-grown fresh produce and all it could impact

It's the result of having a team comprised of skilled farmers, plant geneticists, and R&D scientists that pushed the company into a whole new ring of investing: public trading.

“One of the reasons we're going public is it allows us to continue innovating on the tech side and make continued advancements to reduce capital cost, operating costs, and improve quality. We are investing millions a year in R&D. AeroFarms is involved in some cutting-edge, pioneering work, which attracts a lot of interest in this space. We’re also working with other big companies to accelerate innovation cycles, such as Dell and others—companies you don't typically associate with agriculture. We're partnering with them and developing some breakthrough stuff,” David points out, bringing us back to thinking out of the box and of traditional teams.

Among the areas AeroFarms is looking to further transform includes automation across seeding, harvesting, cleaning, packaging, and beyond, as well as biological development, working to understand what plants need to help realize their full potential.

“There's a strong lens towards technical innovation. I see a lot of players in the industry looking at produce as an execution play, not realizing there's a lot more room to reduce capital and operating costs,” he shares.

It is in that spirit that AeroFarms has continued to launch new products, most recently expanding its leafy greens product assortment for both baby leafy greens and microgreens, as it seeks to redefine not just indoor-grown fresh produce, but all it could impact.

AeroFarms is looking to further transform areas such as automation across seeding, harvesting, cleaning, packaging, and beyond, as well as biological development.

“We're very mission focused,” David concludes of the company’s driven success. “We have a program with past offenders where we've successfully taken people who were previously incarcerated and given them good jobs with a better pathway in life. We also have internal programs where computer literacy and financial literacy training continue to foster growth. Environmentally, we're focused on how to do more with less. How do we continue to grow a plant using less energy, less water, less nutrients, and zero pesticides? I think these commitments and our mission to grow the best plants possible for the betterment of humanity are why we're attracting so many new employees as we seek to build a better future.”

As we continue to eye such movers and shakers throughout fresh produce, continue to follow AndNowUKnow.