Welcome to iGrow News, Your Source for the World of Indoor Vertical Farming

AeroFarms and Nokia Bell Labs Partner to Further AI-Plant Technology

AeroFarms and Nokia Bell Labs have unveiled a multi-year partnership. The goal is to combine their expertise and expand their joint capabilities in cutting-edge networking, autonomous systems, and integrated machine vision and machine learning technologies to identify and track plant interactions at the most advanced levels

By Johnny Eppich

August 11, 2021

AeroFarms and Nokia Bell Labs have unveiled a multi-year partnership. The goal is to combine their expertise and expand their joint capabilities in cutting-edge networking, autonomous systems, and integrated machine vision and machine learning technologies to identify and track plant interactions at the most advanced levels.

As part of this partnership, AeroFarms, a global leader in indoor vertical farming, contributes its commercial growing expertise, comprehensive environmental controls, an agriculture-focused data platform, and machine vision core foundation.

Nokia Bell Labs, the industrial research arm of Nokia, contributes its autonomous drone control and orchestration systems, private wireless networks, robust image and sensor data pipelines, and innovative artificial intelligence (AI) enabled mobile sensor technologies.

AeroFarms and Nokia Bell Labs have been working together since 2020. They have reached a milestone of achieving a proof of concept for this state-of-the-art integrated system and testing the technologies with AeroFarms’ current commercial crop varieties.

Together, they plan to scale this system to all of AeroFarms’ crops and future indoor vertical farms, including the next ones in Danville, VA, and Abu Dhabi.

The integration of Nokia Bell Labs’ AI-enabled drone-based sensors and advanced machine learning, computer vision, and data analytics technologies with AeroFarms’ existing machine vision tools enhances and elevates AeroFarms’ position as an agriculture platform and capabilities organization dedicated to solving food and agriculture supply chain challenges.

“With Nokia Bell Labs, we have developed the next-generation system that can image every plant every day in a cost-effective way at scale,” says David Rosenberg, CEO at AeroFarms. “This level of detailed imaging and insights helps us be better farmers by monitoring our plant biology dynamically and allowing us to course-correct as needed to ensure the highest level of quality all year round.”

Nokia Bell Labs’ machine vision technology has enabled the most precise data capture yet, down to the level of individual plants, using leaf size segmentation, quantification, and pixel-based scanning to identify consistency and variation.

Going beyond what even the human eye can perceive, this state-of-the-art imaging technology enables the gathering of immense insights about a plant, including its leaf size, stem length, coloration, curvature, spotting, and tearing.

The end-to-end system is flexible and robust, built to take advantage of Nokia’s 5G private wireless network with cloud processing technology. The network is designed for low latency and high privacy in an on-premises network. It also provides intelligent industrial analytics capabilities as an integrated service that can be deployed quickly and efficiently anywhere.

“Nokia Bell Labs is driven to solve hard and impactful problems, and together with AeroFarms, we are building the ability to see and identify plant interactions at unprecedented levels,” says Thierry Klein, Vice President of Integrated Solutions and Experiences Research Lab at Nokia. “The fundamental technologies of this partnership are our strength, and vertical farming is just the beginning. With the AeroFarms platform, we are exploring the power of network-driven intelligence for industrial outcomes. These capabilities can expand into a multitude of indoor industrial operations, including logistics, warehousing, distribution hubs, and manufacturing.”

AeroFarms Is Trying To Cultivate The Future of Vertical Farming

2021 is turning out to be quite the year for Newark, New Jersey-based vertical farming pioneer AeroFarms.

By Jesse Klein

August 10, 2021

2021 is turning out to be quite the year for Newark, New Jersey-based vertical farming pioneer AeroFarms.

The biggest news is that the company is going public. In March, it announced a merger with a blank-check firm, Spring Valley Acquisition Corp., that will see the company traded publicly later this year under the ticker ARFM. Also in March, AeroFarms announced a research and development partnership with Hortifrut to push vertical farming technology into the lucrative $39.8 billion berry market, reducing its dependency on revenue from leafy greens. And in July, AeroFarms rebranded its Dream Greens produce line to AeroFarms to capitalize on its name recognition. At the same time, it expanded into five new leafy green products: Baby Bok Choy, The New Spinach, Micro Arugula, Micro Broccoli, Micro Kale and Micro Rainbow Mix. And in August, AeroFarms announced another partnership with Nokia Bell Labs, the New Jersey-based historic scientific research firm, to take its technology to the next level with increased networking, advanced autonomous systems, machine vision and machine learning technologies.

The company is obviously picking up steam. The public market offering and the capital gained during the process will be crucial for AeroFarms to reach the next level of its growth and to achieve several strategic expansions, including improving operational and energy efficiency, adding into new products (right now it’s focusing on berries), and maintaining its social impact.

"We told investors, we view this as a long-term industry," CEO David Rosenberg said. "It is going to be massive. We feel we have a strong leadership position in the industry from a technology standpoint. So how do we build upon that and really double down on the tech producing [capital expenditures], reducing [operating expenses] and improving quality as well as new varieties of plants on this platform."

AeroFarms was founded in 2004, and its products are sold in 200 grocery stores across the Northeast including Whole Foods. It operates one vertical farm in New Jersey, with more on the way. AeroFarms is breaking ground on a facility in Abu Dhabi, pitched as the world’s largest vertical farm, as well as one in Danville, Virginia. Along with the publicly announced farms in Abu Dhabi and Danville, AeroFarms plans to build 16 more farms with the capital it’s raising, using a slightly different strategy than the company’s previous build locations.

"It’s not where the mouths are, but where the produce distribution centers are," Rosenberg said. "So we can sell to a surrounding number of cities. We’ve gone from a lens of hyper local to a more looser definition of local."

AeroFarms uses aeroponics, a soilless way of growing produce that uses mist to cut down on water usage by 95 percent; it plants seeds in cloth made from recycled plastic bottles. Using LED lights, the vertical farms draw on specific wavelengths to maximize efficiency of the plants’ photosynthesis.

The vertical farming industry, already an important part of the food supply chain, is poised to explode. According to a 2020 report by the World Wildlife Fund, indoor farming is projected to have a combined annual growth rate of more than 24 percent between 2018 and 2024, hitting $3 billion in revenues worldwide in 2024. The challenges and opportunities faced by AeroFarms over the next few years will inform the vertical farming playbook for its followers.

Energy is the next big hurdle

The SPAC merger is expected to bring AeroFarms $317 million in cash, on top of the $80 million the company already has, to scale and expand into new geographies. According to Rosenberg, the company focused most of the last 15 years on innovating its technology, seeds and plants. He is confident its technology can support a massive jump in demand and commercialization.

Energy stands out as one of the bigger hurdles facing the [vertical farming] industry.

But the process of scaling up vertical farming isn’t without controversy. A World Wildlife study that compared the life cycle assessment of lettuce grown traditionally in California and transported to St. Louis against indoor farming solutions based in St. Louis — including greenhouse hydroponically grown lettuce, greenhouse aquaponically grown lettuce, indoor vertically farmed lettuce, hydroponically grown lettuce and indoor vertically farmed, aquaponically grown lettuce — found that the energy required to run the lights, irrigation and automation for all the indoor solutions resulted in an overall higher climate impact than the traditional farming method.

"Energy stands out as one of the bigger hurdles facing the [vertical farming] industry," said Julia Kurnik, director of innovation startups at WWF and author of the study. "Because it already is making great gains around things like water use, pesticide use, food loss and food waste. So it’s doing wonderful things there."

According to Kurnik, hydroponics and aeroponic farming use less water and don’t degrade soil like traditional farming, but for vertical farming to become environmentally sustainable on a carbon emissions level, these systems need to source electricity from renewables such as solar, wind or hydro.

But simply hooking up a vertical farm to solar or wind power won't solve the problem. Manufacturing solar panels is also an environmental strain due to the materials mined and energy used to make the solar panels. Like Kurnik said, everything that produces energy has to be built. And on the business side, AeroFarms said it’s very difficult for the company to find locations that have access to 100 percent renewable energy.

According to Rosenberg, access to a greener grid is part of AeroFarms’ weighting process for picking new locations for farms, but it can’t be a dealbreaker. For example, Danville relies heavily on nuclear and natural gas for energy, which is one reason AeroFarms decided to build there. Rosenberg also hopes AeroFarms will start to focus on places and cities that have access to hydropower.

But both Kurnik and AeroFarms CTO Roger Buelow agreed that one of the main goals for both the industry and AeroFarms specifically should be reducing the energy intensity of vertical farm growing.

"Let’s be more efficient," Buelow said. "Let’s make sure we are getting the most pounds per square meter per photon we can get. So that we’re really being good stewards with that energy. And we’re making sure that every photon gets to do its job."

One way AeroFarms does this, according to Buelow, is to put a lot of effort into making sure it uses the most efficient LED lights. But Rosenberg emphasizes that there is more to the environmental picture than just energy usage. He notes that aeroponic farming doesn’t use pesticides, herbicides or fungicides, which all have embodied energy in their production and produce degradation effects on the environment.

"There’s the environmental picture. There’s the energy side. There’s the pollution side. There’s the soil degradation side. There’s the water usage side. The water contamination side. There’s the food waste side," he said. "It’s part of a much broader narrative in assessing what’s good or what’s not as smart for the environment."

Working on expanding crop offerings

According to the WWF study, energy represents about 25 percent of the operating costs for vertical farms, and those costs have limited what is profitable to grow in contained-environment agriculture.

"I’ve seen pretty much anything, even fruit trees growing in these systems," Kurnik said. "But it isn’t cost-effective or energy-effective. You would spend so much energy growing them, it would bring a large environmental footprint, and it would become too expensive for the farms to sell that produce. So to see the entire industry scale and be able to grow a much greater variety of things and therefore capture all the benefits that these farms do bring, we need to figure out how to lower and/or green that energy footprint."

Berries are a high-value crop that could make the investment on the vertical farming side worthwhile for businesses such as AeroFarms.

AeroFarms is working on breaking out of the leafy green market and making some of those more energy-intensive crops profitable. The company has grown 550 varieties of plants in at least the research phase and is participating in a trial of growing a pharmaceutical ingredient for a drug. But the most likely success story will be the berries it hopes to cultivate working alongside Hortifrut.

"[The partnership] is a great example of how we really think of ourselves as a platform," Rosenberg said. "And how we work on this platform to solve broader problems in agriculture."

Berries are a fickle fruit in the agriculture world. Berries are part of the Dirty Dozen, a list of 12 produce types created by nonprofit The Environmental Working Group that use a lot of pesticides. They are also a high-demand product that people want year-round but that only grow best in summer months, leading to massive transportation costs (both financially and environmentally) as the industry ships berries from farther away places to meet this demand. With that in mind, berries are a high-value crop that could make the investment on the vertical farming side worthwhile for businesses such as AeroFarms.

"It’s local. It’s perishable. There’s a reliable demand. There’s a need for consistency. There’s a need for pesticide-free, herbicide-free," said AeroFarms CFO Guy Blanchard. "There’s many, many markets that look like they could very well make sense [for vertical farming]. We’re at the forefront of looking for those types of crops and markets and finding ways to deploy the technology to address those markets."

One example of that initiative: AeroFarms is also a founding member of Precision Indoor Plants (PIP), a joint venture between The Foundation for Food and Agriculture Research and other participants including BASF, Benson Hill, FFAR, Fluence, GreenVenus and Priva. The consortium is working on genetically adapting seeds for optimized indoor growing, improving light recipes, advancing speed breeding technology and altering the chemical makeup of plants to improve flavor, nutrition and medical efficacy.

"The broader world of vertical farming will have access to all those genetics, and we’ll all be able to grow stronger plants that really make the best use of the features of vertical farms," Buelow said.

PIP and AeroFarms plan to share their findings and innovations with the broader vertical farming community so every business in the industry can operate as efficiently as possible.

"I do think there is a lack of knowledge sharing and best practices across the industry," Kurnik said. "Because it is a bunch of startups. It is very nascent. I think the entire industry could benefit from sharing and establishing metrics and a baseline to figure out how to improve."

Balancing automation alongside social goals

The sustainability of farming and food are huge social issues as much as they are environmental ones. According to Rosenberg, one reason AeroFarms chose to locate a farm in Danville was because of the social impact it could make there. The city is 51 percent African American and has a relatively higher poverty rate than its neighbors.

By entering an economically depressed city, AeroFarms can address food deserts and help alleviate them by providing locally sourced food and creating jobs. The Danville operation will employ about 100 people from the community, according to Rosenberg. "We want to go into those communities and inspire those communities," he said.

AeroFarms also supports a past offenders program that started in 2016 and provides employment for 15 formerly incarcerated people so far.

Automation is coming, and it is one way AeroFarms will decrease costs. But that could undermine the jobs added by the company in the future. Right now, the company automates the seeding process, but the seedlings are placed in trays manually. The loading, unloading, harvesting and packaging is automated but pockets of manual work are needed as well. AeroFarms wants to use the best technology while still providing jobs, according to executives.

Vertical farms are often a collision of education levels; highly educated engineers working alongside farm labor.

"Obviously, our next farms are going to be more automated, much more automated and that innovation is something we are proud of," said Diego Rivera, Aerofarms’ master grower. "But even with automation, nothing is going to replace the human eye. Some key positions are going to be still there."

So it’s going to be about retraining. According to Rivera, Aerofarms has programs in place that create conditions for people to stay at the company by promoting people from within.

"Our approach is going to innovate and continue to work to bring our workforce along with us," Rosenberg added. "How do we train for those next skills? How do we get them to understand how to use those controls so they could apply their contribution in a higher level way? We’re constantly training them to be ready for the next challenges."

To provide employees with the opportunity for upward mobility, AeroFarms offers computer literacy programs and financial literacy workshops. According to Rosenberg, vertical farms are often a collision of education levels; highly educated engineers working alongside farm labor.

"So how can we get the highly educated workforce to work with our frontline workers to teach them these skills and help form that sense of community," Rosenberg added.

It’s clear vertical farming sits right in the middle of many of the largest issues facing our economy and our planet. AeroFarms is trying to tackle a lot of them; everything from food insecurity to energy usage to job sustainability. Succeeding could create a path leading others towards a sustainable and equitable economy of the future for others to follow, while failing will offer a parable of trying to be all things to all people and biting off more than you can chew.

AeroFarms and Nokia Unveil Partnership for Next Generation AI-Enabled Plant Vision Technology

AeroFarms and Nokia Bell Labs today unveiled a groundbreaking multi-year partnership to combine their expertise and expand their joint capabilities in cutting-edge networking, autonomous systems, and integrated machine vision and machine learning technologies to identify and track plant interactions at the most advanced levels.

August 5, 2021

NEWARK, N.J.--(BUSINESS WIRE)--AeroFarms and Nokia Bell Labs today unveiled a groundbreaking multi-year partnership to combine their expertise and expand their joint capabilities in cutting-edge networking, autonomous systems, and integrated machine vision and machine learning technologies to identify and track plant interactions at the most advanced levels.

As part of this partnership, AeroFarms, a Certified B Corporation and global leader in indoor vertical farming, contributes its commercial growing expertise, comprehensive environmental controls, an agriculture-focused data platform, and machine vision core foundation. Nokia Bell Labs, the world-renowned industrial research arm of Nokia, contributes its groundbreaking autonomous drone control and orchestration systems, private wireless networks, robust image and sensor data pipelines, and innovative artificial intelligence (AI) enabled mobile sensor technologies. This combination of innovative technologies allows AeroFarms to reach the next level of imaging insights that further enhance its capabilities as an industry leading operator of world-class, fully-connected smart vertical farms that grow the highest quality plants all year round.

AeroFarms and Nokia Bell Labs have been working together since 2020 and have reached an important milestone of achieving a proof of concept for this state-of-the-art integrated system and testing the technologies with AeroFarms’ current commercial crop varieties. Together, they are now ready to scale this system to all of AeroFarms’ crops and future indoor vertical farms, including the next ones in Danville, Virginia and Abu Dhabi, UAE.

The integration of Nokia Bell Labs’ AI-enabled drone-based sensors and advanced machine learning, computer vision and data analytics technologies with AeroFarms’ existing machine vision tools enhances and elevates AeroFarms’ position as an agriculture platform and capabilities organization dedicated to solving food and agriculture supply chain challenges.

David Rosenberg, CEO at AeroFarms, said: “With Nokia Bell Labs, we have developed the next-generation system that can image every plant every day in a cost-effective way at scale. This level of detailed imaging and insights helps us be better farmers by monitoring our plant biology dynamically and allowing us to course correct as needed to ensure the highest level of quality all year round. When I watch the drones autonomously imaging our plants, I am blown away by how this truly represents the power of harnessing leading-edge technologies and bringing brilliant problem solvers together from diverse groups to grow the best plants possible.”

Roger Buelow, CTO at AeroFarms, said: “AeroFarms’ expert team of plant scientists and engineers have been working together for two years with Nokia Bell Labs’ top researchers and engineers to train these complex learning systems with a nuanced understanding of plant biology. We have created a cross-disciplinary understanding at an industrial scale to develop the latest imaging technology to help accelerate our ability to introduce new crops and ensure the highest quality for our commercial operations.”

Nokia Bell Labs’ machine vision technology has enabled the most precise data capture yet, down to the level of individual plants, using leaf size segmentation, quantification, and pixel-based scanning to identify consistency and variation. Going beyond what even the human eye can perceive, this state-of-the art imaging technology enables the gathering of immense insights about a plant including its leaf size, stem length, coloration, curvature, spotting, and tearing. The end-to-end system is flexible and robust, built to take advantage of Nokia’s industry-leading 5G private wireless network with cloud processing technology, designed for low latency and high privacy in an on-premises network. It also provides intelligent industrial analytics capabilities as an integrated service that can be deployed quickly and efficiently anywhere.

Thierry Klein, VP, Integrated Solutions and Experiences Research Lab at Nokia, said: “Nokia Bell Labs is driven to solve hard and impactful problems, and together with AeroFarms, we are building the ability to see and identify plant interactions at unprecedented levels. The fundamental technologies of this partnership are our strength, and vertical farming is just the beginning. With the AeroFarms platform, we are exploring the power of network driven intelligence for industrial outcomes. These capabilities can expand into a multitude of indoor industrial operations, including logistics, warehousing, distribution hubs, and manufacturing.”

The multi-year partnership between AeroFarms and Nokia is anchored on shared values as mission-driven companies with the vision to scale technologies for the greater good. AeroFarms’ vertical farming platform is more sustainable than traditional farming with up to 390 times greater productivity per square foot annually, while using up to 95% less water and zero pesticides. In addition, vertical farming provides local food options for communities, reducing the environmental impact of trucking and shipping produce long distances and helping combat food waste.

Additional resources

AeroFarms website

Nokia Bell Labs website

About Nokia

At Nokia, we create technology that helps the world act together. As a trusted partner for critical networks, we are committed to innovation and technology leadership across mobile, fixed and cloud networks. We create value with intellectual property and long-term research, led by the award-winning Nokia Bell Labs. Adhering to the highest standards of integrity and security, we help build the capabilities needed for a more productive, sustainable and inclusive world.

About AeroFarms

Since 2004, AeroFarms has been leading the way for indoor vertical farming and championing transformational innovation for agriculture. On a mission to grow the best plants possible for the betterment of humanity, AeroFarms is a Certified B Corporation with global headquarters in Newark, New Jersey. Named one of the World’s Most Innovative Companies by Fast Company two years in a row and one of TIME’s Best Inventions in Food, AeroFarms patented, award-winning indoor vertical farming technology provides the perfect conditions for healthy plants to thrive, taking agriculture to a new level of precision, food safety, and productivity while using up to 95% less water and no pesticides ever versus traditional field farming. AeroFarms enables local production to safely grow all year round, using vertical farming for elevated flavor. In addition, through its proprietary growing technology platform, AeroFarms has grown over 550 varieties and has developed multi-year strategic partnerships ranging from government to major Fortune 500 companies to help uniquely solve agriculture supply chain needs. For additional information, visit: https://aerofarms.com/.

On March 26, 2021, AeroFarms announced a definitive business combination agreement with Spring Valley Acquisition Corp. (Nasdaq: SV). Upon the closing of the business combination, AeroFarms will become publicly traded on Nasdaq under the new ticker symbol "ARFM". Additional information about the transaction can be viewed here: https://aerofarms.com/investors/.

No Offer or Solicitation

This press release does not constitute an offer to sell or a solicitation of an offer to buy, or the solicitation of any vote or approval in any jurisdiction in connection with a proposed potential business combination among Spring Valley and AeroFarms or any related transactions, nor shall there be any sale, issuance or transfer of securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful. Any offering of securities or solicitation of votes regarding the proposed transaction will be made only by means of a proxy statement/prospectus that complies with applicable rules and regulations promulgated under the Securities Act of 1933, as amended (the “Securities Act”), and Securities Exchange Act of 1934, as amended, or pursuant to an exemption from the Securities Act or in a transaction not subject to the registration requirements of the Securities Act.

Forward Looking Statements

Certain statements included in this press release that are not historical facts are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “might,” “will,” “estimate,” “continue,” “contemplate,” “anticipate,” “intend,” “expect,” “should,” “would,” “could,” “plan,” “predict,” “project,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. All statements, other than statements of present or historical fact included in this press release, including those regarding the expected benefits of the partnership, improvement of plant yields and quality and Spring Valley’s proposed acquisition of AeroFarms are forward-looking statements. These statements are based on various assumptions, whether or not identified in this press release, and on the current expectations of the respective management of AeroFarms and Spring Valley and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on as, a guarantee, an assurance, a prediction, or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of AeroFarms and Spring Valley. These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political, and legal conditions; the inability of the parties to successfully or timely consummate the proposed transaction, including the risk that any regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed transaction or that the approval of the stockholders of Spring Valley or AeroFarms is not obtained; failure to realize the anticipated benefits of the proposed transaction; risks related to the expansion of AeroFarms’ business and the timing of expected business milestones; the effects of competition on AeroFarms’ business; the ability of Spring Valley or AeroFarms to issue equity or equity-linked securities or obtain debt financing in connection with the proposed transaction or in the future, and those factors discussed in Spring Valley’s Annual Report on Form 10-K, Quarterly Report on Form 10-Q, final prospectus dated November 25, 2020 and definitive proxy statement/prospectus dated July 26, 2021 under the heading “Risk Factors,” and other documents Spring Valley has filed, or will file, with the SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither Spring Valley nor AeroFarms presently know, or that Spring Valley nor AeroFarms currently believe are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Spring Valley’s and AeroFarms’ expectations, plans, or forecasts of future events and views as of the date of this press release. Spring Valley and AeroFarms anticipate that subsequent events and developments will cause Spring Valley’s and AeroFarms’ assessments to change. However, while Spring Valley and AeroFarms may elect to update these forward-looking statements at some point in the future, Spring Valley and AeroFarms specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing Spring Valley’s and AeroFarms’ assessments of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Contacts

AeroFarms Contacts

Investor Relations:

Jeff Sonnek

ICR

Jeff.Sonnek@icrinc.com

1-646-277-1263

Media Relations:

Marc Oshima

AeroFarms

MarcOshima@AeroFarms.com

1-917-673-4602

AeroFarms' David Rosenberg Discusses Growth, Investment, and More

From diving into publicly traded waters and launching a rebrand to introducing several new items and opening a research and development (R&D) hub, it’s safe to say that AeroFarms has come farther than CEO and Co-Founder David Rosenberg envisioned since the beginning days of 2004.

By Melissa De Leon Chavez

July 29, 2021

NEWARK, NJ - From diving into publicly traded waters and launching a rebrand to introducing several new items and opening a research and development (R&D) hub, it’s safe to say that AeroFarms has come farther than CEO and Co-Founder David Rosenberg envisioned since the beginning days of 2004.

David Rosenberg, Co-Founder and Chief Executive Officer, AeroFarms

“When I co-founded the company, I thought of this as a supply chain play. I looked at the inefficiencies and thought, if we could enable local food production at scale, we could disintermediate parts of the supply chain and enable local food production and access to fresh food, starting with leafy greens,” David shares with me.

Fast-forward to today, and AeroFarms is consistently breaking ground, physically and conventionally, in the U.S. and overseas.

“Our new AeroFarms AgX project in Abu Dhabi is two-fold. One, we expect to have a strong presence in the Middle East. Two, it aligns with our value proposition where there's not much farmland. There's not as much fresh water and there's relatively low-cost, abundant energy. Additionally, we're using our presence there to really innovate. We're building the world’s largest indoor vertical farming R&D facility of its kind that is going to have a tremendous amount of innovation in it, from genetics to automation exploration,” he tells me. “We're also doing a lot in the U.S. We just opened a building expansion here in Newark where we have our global headquarters. That's another 25,000-square-foot facility for prototyping and R&D, so we have much going on Stateside as well.”

AeroFarms has revealed several advancements, from diving into publicly traded waters and launching a rebrand to introducing several new items and opening a new research and development (R&D) hub

AeroFarms has a diverse, partner-fueled style that can be seen blueprinted in David's own background. Far from a straight line to agriculture, the executive was drawn to the produce industry by a love of problem-solving.

“My last company was a nanotech company in construction, which focused specifically on waterproofing and corrosion inhibition. From that I learned how much water goes to agriculture and thought I could make a difference. I love when there could be technological solutions to existing issues, and it’s a pattern I have found across industries,” David imparts.

With a background as a multi-business serial entrepreneur from Columbia Business School, it’s no wonder that David and his team have an unorthodox approach to indoor ag, employing several outside minds to expand laterally and vertically the possibilities of the industry.

“What surprised me is that fully controlled agriculture enables us to understand and give a plant exactly what it wants, when it wants, and how it wants it. As a consequence, we're competing on taste and texture in unique ways. So, I used to think our competitive advantage was local and fresh when, it turns out, we have unique tastes that allow us to go further and distinguish us from any other grower out there,” the CEO and Co-Founder muses.

AeroFarms most recently expanded its leafy greens product assortment for both baby leafy greens and microgreens as it seeks to redefine indoor-grown fresh produce and all it could impact

It's the result of having a team comprised of skilled farmers, plant geneticists, and R&D scientists that pushed the company into a whole new ring of investing: public trading.

“One of the reasons we're going public is it allows us to continue innovating on the tech side and make continued advancements to reduce capital cost, operating costs, and improve quality. We are investing millions a year in R&D. AeroFarms is involved in some cutting-edge, pioneering work, which attracts a lot of interest in this space. We’re also working with other big companies to accelerate innovation cycles, such as Dell and others—companies you don't typically associate with agriculture. We're partnering with them and developing some breakthrough stuff,” David points out, bringing us back to thinking out of the box and of traditional teams.

Among the areas AeroFarms is looking to further transform includes automation across seeding, harvesting, cleaning, packaging, and beyond, as well as biological development, working to understand what plants need to help realize their full potential.

“There's a strong lens towards technical innovation. I see a lot of players in the industry looking at produce as an execution play, not realizing there's a lot more room to reduce capital and operating costs,” he shares.

It is in that spirit that AeroFarms has continued to launch new products, most recently expanding its leafy greens product assortment for both baby leafy greens and microgreens, as it seeks to redefine not just indoor-grown fresh produce, but all it could impact.

AeroFarms is looking to further transform areas such as automation across seeding, harvesting, cleaning, packaging, and beyond, as well as biological development.

“We're very mission focused,” David concludes of the company’s driven success. “We have a program with past offenders where we've successfully taken people who were previously incarcerated and given them good jobs with a better pathway in life. We also have internal programs where computer literacy and financial literacy training continue to foster growth. Environmentally, we're focused on how to do more with less. How do we continue to grow a plant using less energy, less water, less nutrients, and zero pesticides? I think these commitments and our mission to grow the best plants possible for the betterment of humanity are why we're attracting so many new employees as we seek to build a better future.”

As we continue to eye such movers and shakers throughout fresh produce, continue to follow AndNowUKnow.

AeroFarms Expands Its Award-Winning Leafy Greens Product Assortment

AeroFarms, a Certified B Corporation and leader in indoor vertical farming, today announced that it is expanding its line of leafy greens to include 5 new items: Baby Bok Choy-The New SpinachTM, Micro Arugula, Micro Broccoli, Micro Kale, and Micro Rainbow Mix

July 13, 2021

NEWARK, N.J.–AeroFarms, a Certified B Corporation and leader in indoor vertical farming, today announced that it is expanding its line of leafy greens to include 5 new items: Baby Bok Choy-The New SpinachTM, Micro Arugula, Micro Broccoli, Micro Kale, and Micro Rainbow Mix.

AeroFarms® award-winning retail brand of leafy greens is prized for its elevated flavor and is grown using proprietary aeroponics and indoor vertical farming technologies, which yield annual productivity up to 390 times greater than traditional field farming while using up to 95% less water and zero pesticides.

There has been increased consumer interest in Asian greens and Future Fusebiquity – as outlined in Datassential’s Food Bytes 2021 Food Trends – that takes new generation products and combines them with well-known dishes. AeroFarms Baby Bok Choy-The New SpinachTM is reimagining how to create a better spinach experience that is juicier, more flavorful, and even more nutrient-dense with an ANDI (Aggregate Nutrient Density Index) score of 865 vs. spinach at 707, and it can be enjoyed in just about any spinach recipe for an updated new take on the dish.

Microgreens were recognized by The Today Show as one of the top health trends for 2021, and AeroFarms has been expanding this category at retail since 2019. Responding to consumer demand, AeroFarms has added Micro Arugula, Micro Broccoli, Micro Kale, and Micro Rainbow Mix to its core line of Micro Spicy Mix and Micro Super Mix. Produced year-round at the highest quality, AeroFarms microgreens offer great visual and flavor excitement, elevating the home cook into a chef. In addition, AeroFarms microgreens provide higher nutrient density than their mature green counterparts, offering a powerful way to provide a potent boost of vitamins, minerals, and phytonutrients.

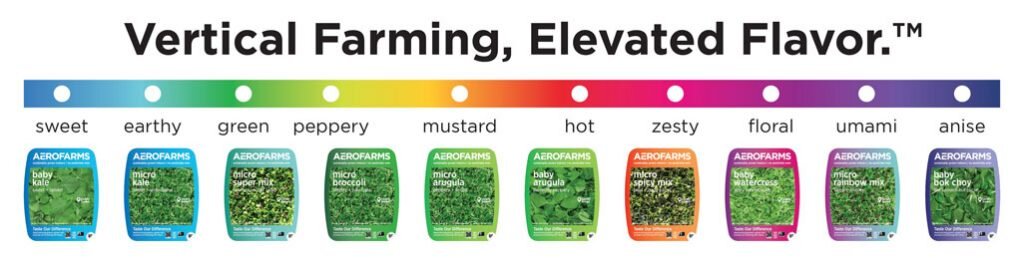

AeroFarms starts by selecting the most flavorful varietals of microgreens and baby greens, then perfects them in its proprietary indoor vertical farms for optimal quality, yield, color, nutrition, texture, and taste. In fact, AeroFarms has trademarked Vertical Farming, Elevated Flavor™ to highlight to consumers not only where and how their food is grown, but also more importantly, the key growing benefits that AeroFarms uniquely brings to the market, setting a new culinary standard with millions of data points to prove it.

AeroFarms is able to grow its kale to be sweeter and its arugula to be perfectly peppery, and the Company has developed its signature FlavorSpectrum™ to represent the breadth of flavors and hundreds of varieties of leafy greens that it is able to grow. AeroFarms’ team of experts from horticulturists to engineers to data scientists to nutritionists paired each specific tasting note with a representative color to bring the FlavorSpectrum™ philosophy to life. Across its leafy greens packaging line, the cool blue tones represent sweet and mellow notes, while the intense reds represent bold and zesty flavors.

All AeroFarms leafy greens are safely grown indoors in New Jersey at one of AeroFarms’ state-of-the art commercial indoor vertical farms that is certified for USDA Good Agricultural Practices, SQF Level 2 Good Manufacturing Practices, Non-GMO Project Verification, and OU Kosher. AeroFarms leafy greens are completely pesticide free, and ready-to-eat without any need to wash, providing a major benefit to consumers looking for safety and convenience. AeroFarms leafy greens are available at major customers such as Amazon Fresh, Baldor Specialty Foods, FreshDirect, Morton Williams, ShopRite, Walmart, and Whole Foods.

“Our Company is committed to partnering with our retail partners to expand the entire category of leafy greens and drive consumption with our sustainably grown produce that is winning on taste,” said David Rosenberg, Co-Founder and Chief Executive Officer of AeroFarms. “We are excited to expand our line of microgreens, which we believe can move from just a garnish to center of the plate given their exceptional taste — microgreens can be enjoyed all of the time!”

About AeroFarms

Since 2004, AeroFarms has been leading the way for indoor vertical farming and championing transformational innovation for agriculture. On a mission to grow the best plants possible for the betterment of humanity, AeroFarms is a Certified B Corporation with global headquarters in Newark, New Jersey. Named one of the World’s Most Innovative Companies by Fast Company two years in a row and one of TIME’s Best Inventions in Food, AeroFarms patented, award-winning indoor vertical farming technology provides the perfect conditions for healthy plants to thrive, taking agriculture to a new level of precision, food safety, and productivity while using up to 95% less water and no pesticides ever versus traditional field farming. AeroFarms enables local production to safely grow all year round, using vertical farming for elevated flavor. In addition, through its proprietary growing technology platform, AeroFarms has developed multi-year strategic partnerships ranging from government to major Fortune 500 companies to help uniquely solve agriculture supply chain needs. For additional information, visit: https://aerofarms.com/.

On March 26, 2021, AeroFarms announced a definitive business combination agreement with Spring Valley Acquisition Corp. (Nasdaq: SV). Upon the closing of the business combination, AeroFarms will become publicly traded on Nasdaq under the new ticker symbol “ARFM”. Additional information about the transaction can be viewed here: https://aerofarms.com/investors/

No Offer or Solicitation

This press release does not constitute an offer to sell or a solicitation of an offer to buy, or the solicitation of any vote or approval in any jurisdiction in connection with a proposed potential business combination among Spring Valley and AeroFarms or any related transactions, nor shall there be any sale, issuance or transfer of securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful. Any offering of securities or solicitation of votes regarding the proposed transaction will be made only by means of a proxy statement/prospectus that complies with applicable rules and regulations promulgated under the Securities Act of 1933, as amended (the “Securities Act”), and Securities Exchange Act of 1934, as amended, or pursuant to an exemption from the Securities Act or in a transaction not subject to the registration requirements of the Securities Act.

Forward Looking Statements

Certain statements included in this press release that are not historical facts are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “might,” “will,” “estimate,” “continue,” “contemplate,” “anticipate,” “intend,” “expect,” “should,” “would,” “could,” “plan,” “predict,” “project,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. All statements, other than statements of present or historical fact included in this presentation, regarding Spring Valley’s proposed acquisition of AeroFarms, Spring Valley’s ability to consummate the transaction, the benefits of the transaction and the combined company’s future financial performance, as well as the combined company’s strategy, future operations, estimated financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. These statements are based on various assumptions, whether or not identified in this press release, and on the current expectations of the respective management of AeroFarms and Spring Valley and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on as, a guarantee, an assurance, a prediction, or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of AeroFarms and Spring Valley. These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political, and legal conditions; the inability of the parties to successfully or timely consummate the proposed transaction, including the risk that any regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed transaction or that the approval of the stockholders of Spring Valley or AeroFarms is not obtained; failure to realize the anticipated benefits of the proposed transaction; risks relating to the uncertainty of the projected financial information with respect to AeroFarms; risks related to the expansion of AeroFarms’ business and the timing of expected business milestones; the effects of competition on AeroFarms’ business; the ability of Spring Valley or AeroFarms to issue equity or equity-linked securities or obtain debt financing in connection with the proposed transaction or in the future, and those factors discussed in Spring Valley’s Annual Report on Form 10-K, Quarterly Report on Form 10-Q, final prospectus dated November 25, 2020 and preliminary proxy statement/prospectus dated May 10, 2021 under the heading “Risk Factors,” and other documents Spring Valley has filed, or will file, with the SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither Spring Valley nor AeroFarms presently know, or that Spring Valley nor AeroFarms currently believe are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Spring Valley’s and AeroFarms’ expectations, plans, or forecasts of future events and views as of the date of this press release. Spring Valley and AeroFarms anticipate that subsequent events and developments will cause Spring Valley’s and AeroFarms’ assessments to change. However, while Spring Valley and AeroFarms may elect to update these forward-looking statements at some point in the future, Spring Valley and AeroFarms specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing Spring Valley’s and AeroFarms’ assessments of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Indoor Farming Is In Growth Mode

The future of indoor farming, including vertical farming, has nowhere to go but up. With parallel and perhaps inevitably colliding trends of sustainability, plant-based eating, food safety and labor-saving agricultural practices, produce grown in controlled environments is likely to become much more common in grocery stores.

By Lynn Petrak

July 9, 2021

The future of indoor farming, including vertical farming, has nowhere to go but up. With parallel and perhaps inevitably colliding trends of sustainability, plant-based eating, food safety and labor-saving agricultural practices, produce grown in controlled environments is likely to become much more common in grocery stores.

As a testament to the sunny future of the ag tech niche, the U.S. Department of Agriculture started a new Office of Urban Agriculture and Innovative Production last year. More than $3 million in initial grants were made available through that department in 2020.

Prognosticators have weighed in on a future of food that includes strategically located indoor farms throughout the country. In a report released late last year, Allied Market Research, whose Americas office is in Portland, Ore., projected that the global vertical-farming industry is expected to reach $1.38 billion by 2027, with a compound annual growth rate (CAGR) of 26.2% from 2021 to 2027.

Several grocers are already buying into this type of produce supply. Earlier this year, The Kroger Co., based in Cincinnati, began sourcing fresh produce from Hamilton, Ohio-based indoor grower 80 Acres Farms for the retailer’s stores in Ohio, Indiana and Kentucky. In 2020, Kroger partnered with German startup Infarm to add modular vertical farms to two of its Quality Food Centers in the Seattle area.

Also last year, Publix Super Markets said that it will invest more in hydroponic produce and added a new on-site trailer farm from a local hydroponic grower to its GreenWise Market store in the grocer’s hometown of Lakeland, Fla. Boise, Idaho-based Albertsons Cos. has collaborated with South San Francisco, Calif.-based Plenty and with Bowery Farming, based in New York, to provide its shoppers with fresh produce grown indoors. Natural and organic retailer Whole Foods Market, based in Austin, Texas, recently added a mini-farm from New York-based Farm.One to one of its Big Apple stores to provide herbs for prepared pizzas and drinks. In addition to these and other large grocery players, smaller chains and independents have teamed up with various greenhouses and growing operations near their locations.

Consumers have expressed their opinions about produce grown indoors. According to the 2021 “Power of Produce” report published by Arlington, Va.-based FMI – The Food Industry Association, and conducted by San Antonio-based 210 Analytics, 43% of shoppers don’t have a preference for produce coming from indoor versus outdoor farms. Those most likely to prefer indoor growing include urbanites, consumers with above-average spend per person, members of the Generation Z age demographic, higher-income households, core value-added shoppers, organic produce buyers and men. Those more likely to prefer outdoor-grown produce include consumers in rural areas and conventional produce buyers, the report found.

AeroFarms uses aeroponic methods to grow healthy plants, using up to 95% less water and no pesticides.

Greener Pastures

One of the biggest drivers of the move to produce more food in indoor-farming facilities is sustainability. From an environmental standpoint, indoor-grown produce may be part choice, part necessity, depending on the area and the circumstances.

Necessity is born of conditions wrought by continual weather extremes that are often attributed to a changing climate. Unusual weather patterns resulting in droughts, floods, storm damage and harmful freezes take a toll on traditional farms and on the farmers who grow fresh fruits and vegetables.

Weather extremes have always happened, but are becoming more frequent. For example, coming off last summer’s devastating derecho event, a drought that began in late 2020 in Iowa and has continued through early summer is stressing that state’s corn and soybean crops. Earlier this year, rare heavy snow, ice and frigid temperatures in Texas hurt winter wheat and some citrus crops.

At the same time, there’s an overall push to produce food in a more sustainable way. More than two-thirds (64%) of American consumers say that they’re willing to pay a premium for environmentally friendly products. “There is a trend – not a fad – of consumers who appreciate the benefit of getting produce soon after it’s harvested,” says David Rosenberg, co-founder and CEO of vertical-farming leader AeroFarms, based in Newark, N.J., “and more and more customers are realizing that they want products with no pesticides, because those are not meant for human beings.”

On the business side, sustainability is a central part of many CPGs’ and grocers’ corporate- responsibility platforms as they pledge to reduce their use of resources like water and energy. Many manufacturers and retailers have also revealed goals to cut down on or eliminate the use of pesticides in their products.

Other Seeds of Change

In addition to the pursuit of sustainable growing practices, other factors are contributing to interest in this method of agriculture. The need to shore up food security in the face of a booming global population and the problem of urban food deserts are notable catalysts. So is consumers’ penchant for eating more fresh plant-based foods, and foods grown in a more sustainable way.

Meanwhile, as evidenced in ubiquitous “Now hiring” signs, it can be tough to find workers to plant, care for and harvest crops. Indoor farms run with several automated controls and tasks are less affected by fluctuations and stresses in the labor market.

The global COVID-19 pandemic also contributed to the acceleration of indoor farming. When some retailers faced supply chain issues and had difficulty sourcing fresh products, they turned to new vendor partners that operated indoor farms with more controlled conditions and inventories. Indoor farms typically can be built faster and are also versatile operations that allow for pivots in the event of changing circumstances.

There are additional practical reasons for sourcing produce from indoor growers. “Right now, retailers want consistency in price, quality and delivery. At its core, we are delivering consistency,” notes Rosenberg, citing other profit-driven benefits such as reduced shrink and spoilage.

Modern indoor farms combine technology and agriculture to provide fresh produce in a more sustainable way.

Indoor-Farm Tour

Generally, plants in indoor-farming facilities are grown in cells stacked for space savings and efficiency. In lieu of the sun, LED lights are used to facilitate growth.

Watering techniques vary. In hydroponic farms, plant roots are placed in nutrient-rich solutions instead of soil. With aeroponics, exposed roots hang down from the plant and receive nutrients via a system that sprays nutrient-filled water.

Indoor farms take different forms in the United States and around the world. Some indoor farms are massive in size and almost industrial in their setup. Others are smaller and hyperlocal, using locations like repurposed shipping containers or greenhouses. Some farms are constructed vertically to minimize the physical footprint or to use existing buildings, while others are more spread out in their design. Farms are being built in urban areas, often in former manufacturing facilities, warehouses or multilevel stores, and in more rural areas, where they are run by longtime family farm owners who are looking for ways to reinvent their businesses in the wake of competition from big farms.

One thing is for sure: There are more of these types of growing operations. AeroFarms is one grower on the march, with a l36,000-square-foot aeroponics farm under construction in Virginia, set to be finished sometime in 2022.

In June, Vertical Roots, a Charleston, S.C.-based hydroponic container farm that’s part of Amplifed Ag, opened its third indoor farm in Atlanta at a facility run by two large produce suppliers in the Southeast. According to the company, the new farm will eliminate the need for transportation to the distributor and will enable produce to be delivered to local customers the same day that it’s harvested.

In mid-June, Morehead, Ky.-based grower AppHarvest revealed that it’s adding two large indoor farms in the Bluegrass State. With a completion date of the end of 2022, the farms will produce non-GMO leafy greens and fruits for shipment to grocers and restaurants.

Also in 2021, Irvington, N.Y.-based BrightFarms opened its newest indoor farm, in Hendersonville, N.C., a 6-acre greenhouse that will deliver to retailers in nearby areas in that state, as well as in South Carolina and Georgia.

Startup Bowery Farms is opening an R&D hub called “Farm X” that will help expand product development. The facility includes a new sensory lab and innovation center.

In another sign of the health of this sector, there’s major seed money – no pun intended – going toward indoor farming. Berlin-based Infarm, for example, is said to be going public following a reported merger with Kernel Group Holdings Inc., of San Francisco. In May, Bowery Farming revealed a new round of funding to the tune of $300 million that lifted the company’s estimated value to about $2.3 billion. Indoor-farming company Gotham Greens, based in Brooklyn, N.Y., revealed $87 million in new funding in December 2020.

While indoor farms are expanding, crops produced in such facilities are expected to grow, too. Most ag tech companies currently produce leafy greens and herbs in hundreds of different varieties. Tomatoes are also grown hydroponically in many places. Better technologies and a greater collective knowledge are spurring innovations in other types of crops grown indoors in an eco-friendlier way. AppHarvest, for its part, is growing strawberries in one of its new locations, and vine crops in another.

Implications for the Retail Produce Section

More and different types of indoor farms are transforming agriculture – and the retail produce department. Since many of these products are packaged on site, supermarket produce sections now feature a greater mix of packaged and bulk items. Offerings like packaged salads and tomatoes also help define and elevate a brand, whether it’s a store brand or a grower brand.

Coming off a year in which consumers prepared more foods and experimented with new products and varieties, several new products grown in indoor-farming facilities have hit the marketplace. Medford, Minn.-based Revol Greens recently rolled out new varieties of chopped romaine salads made with lettuces grown at its indoor farm in its home state. Revolution Farms, in Caledonia, Mich., is launching four new salad mixes. One of Bowery Farming’s latest products is a new Bowery Crispy Leaf Lettuce, deemed to be a “reinvigorated version” of iceberg lettuce. And that’s just the tip of the iceberg (lettuce).

Grocers can merchandise indoor-farmed produce in a creative way to distinguish their offerings and connect with shoppers. “We’ve worked in a process of co-creating with retailers,” observes AeroFarms’ Rosenberg. “It is an opportunity to deliver innovation and excitement for an exciting category.”

Lead Photo: Hydroponic farming company Vertical Roots is growing its footprint with a new indoor lettuce farm in the Atlanta area.

A Primer On Vertical Farming As The Industry Gains Steam

Nearly $1.9 billion of global venture capital was invested in indoor farming in 2020, nearly tripling investment in 2019. And just this week, New York-based vertical farming startup Bowery Farming raised $300 million in its latest funding round, valuing the company at $2.3 billion.

Rich Alternman

May 28, 2021

The modern concept of vertical farming was put forth in 1999 by Columbia University microbiologist Dickson Despommier, who along with his students, came up with a design of a skyscraper farm that could feed 50,000 people.

Since then, vertical farming has become a multi-billion-dollar industry. And it’s growing rapidly.

According to PitchBook data, nearly $1.9 billion of global venture capital was invested in indoor farming in 2020, nearly tripling investment in 2019. And just this week, New York-based vertical farming startup Bowery Farming raised $300 million in its latest funding round, valuing the company at $2.3 billion.

Vertical farming growth may be accelerating at the ideal time, as concerns about population growth and climate change push the food industry to innovate to meet tomorrow’s challenges.

By 2050, around 68% of the world population is expected to live in urban areas, and this growth will lead to an increased demand for food. The use of vertical farming could play a role in preparing for such a challenge. At the same time, it could help restore forests depleted by commercialized agriculture and curb planet-warming emissions caused by farming and transportation. Agriculture and forestry alone account for about a quarter of the world’s greenhouse gases.

What is it?

Vertical farming is the practice of growing crops in vertically stacked layers as opposed to a single level, like a field or greenhouse.

Through the artificial control of temperature, light, humidity, and gases, food can be produced indoors in a way that optimizes plant growth and soilless farming techniques such as hydroponics, aquaponics, and aeroponics. The benefits of which are reliable, environmentally friendly, year-round crop production, significantly reduced water usage (by some estimates up to 95% less), efficient land use, and less exposure to chemicals and disease.

Among its downsides, vertical farms are costly to set up and operate and are too dependent on technologies that have yet to reach full maturity. Further, with its heavy reliance on electricity for lighting and climate control, it uses more energy than traditional farming methods and contributes to greenhouse gas emissions.

With that, the sector continues to innovate. And with vertical farming merely in its infancy, it’s reasonable to expect big things in the coming decades.

Investors certainly think so.

In fact, the global vertical farming market is projected to reach $12.77 billion by 2026, growing at a CAGR of 24.6%, according to Allied Market Research.

Some recent examples of vertical farming going mainstream include:

Newark, N.J.-based AeroFarms planning to double its product offering at Whole Foods and, for Amazon Fresh, expanding from one to five distribution centers, increasing availability throughout the New York metropolitan area.

Albertsons Cos. rolling out indoor-farmed produce from Bowery Farming to 275 Acme and Safeway stores in the Northeast and Mid-Atlantic.

The Kroger Co. rolling out produce from vertical farm 80 Acres Farms to more than 300 stores in Ohio, Indiana and Kentucky.

Giant Eagle introducing more packaged greens products from vertical- and robotic-farming specialist Fifth Season to supermarkets in Pennsylvania and Ohio.

Cost barriers

While investors and environmentalists alike are excited by the prospects of vertical farms, the cost barriers are significant, around 20% to 30% higher than traditional farms.

With that, investors may not be able to live up to the hype they’ve created around the industry, and see their bubble burst before they have a chance to prove themselves, said IDTechEx analyst Michael Dent, in a Bloomberg News article. “If people are expecting world-changing progress and they don’t see it in the first two or three years — and what they see is high-quality salad — there’s a chance they might pull out their investment on the field and move on to the next thing.”

No Dirt? No Farm? No Problem. The Potential For Soil-Less Agriculture Is Huge

It’s a growing industry — $9.5 billion in sales is expected to nearly double in the next five years — that stems, in part, from concerns about growing enough food to feed a worldwide population expected to hit 10 billion in the next 30 years.

At Plenty’s South San Francisco hydroponics growing facility, a million plants produce leafy greens that are sold through area grocery stores. The company plans to open a farm in Compton this year.

(Plenty)

Imagine kale that doesn’t taste like a punishment for something you did in a previous life. Envision leafy greens that aren’t limp from their journey to your plate. Anticipate the intense flavor of just-picked herbs that kick up your latest culinary creation a notch or three.

Then consider the possibility that such advancements will play a role in altering the face of agriculture, becoming sources of flavorful, fresh produce in “food deserts” and making farm-to-table restaurant cuisine possible because produce is grown on the premises, even in urban areas.

This is the potential and the promise of hydroponics (a term that also includes aeroponics and aquaponics systems), the soil-less cultivation of crops in controlled environments. It’s a growing industry — $9.5 billion in sales is expected to nearly double in the next five years — that stems, in part, from concerns about growing enough food to feed a worldwide population expected to hit 10 billion in the next 30 years.

The growing method isn’t new. The Hanging Gardens of Babylon, dating to the 6th century B.C., maybe a precursor to today’s hydroponics, if they existed. (Historians disagree on that as well as where the gardens were.) Then, as now, technology is a key to giving growers, not Mother Nature, more control overproduction.

The size of today’s systems varies. They might be as simple and compact as an in-home system that’s about the size of a couple of loaves of bread stacked on top of each other. Some of the growing popularity of those units may be connected to the pandemic, according to Paul Rabaut, director of marketing for AeroGarden, which produces systems for in-home crop production.

“As soon as the pandemic was declared in mid-March and the quarantine took effect, we saw immediate growth spikes, unlike anything we’d ever seen before,” he said. Those spikes resulted, he said, from the need for entertainment beyond Netflix and jigsaw puzzles, a desire to minimize trips to the grocery store and the promise of teachable moments for kids now schooled at home.

At the other end of the spectrum are large urban farms. Plenty, for instance, has a South San Francisco hydroponics growing facility where a million plant sites produce crops, some of which are sold through area grocery stores. The company hopes to open a farm in Compton this year that’s expected to be about the size of a big-box store and will grow the equivalent of 700 acres of food.

Plenty scientists, engineers and growers at work in their South San Francisco hydroponics growing facility.

(Plenty)

“It’s a super vibrant community with a rich agricultural history,” Nate Storey, a cofounder of the vertical farming company, said of the Compton facility. “It also happens to be a food desert.

“Americans eat only about 30% of what they should be eating as far as fresh foods,” he said. “We started this company because we realized the world needed more fresh fruits and vegetables.”

As different as hydroponics growing systems are, most have this in common: The plants thrive because of the nutrients they receive and the consistency of the environment and can produce crops of fresh leafy greens and other vegetables, various herbs and sometimes fruits.

Such controlled-environment agriculture is part of the larger trend of urban farms, recognized last year by the May opening of the U.S. Department of Agriculture’s Office of Urban Agriculture and Innovative Production. The farms’ proximity to larger markets means produce can be delivered quickly to consumers, whether they’re grocery shoppers, airline passengers, students or communities in need or restaurants, an industry that has been devastated in the last year.

Today’s micro-and mega-farms have taken on increased importance, partly because of world hunger, which will increase as the population grows.

Add increasing urbanization that is gobbling available agricultural land in many countries, mix in climate change and the scramble for water to grow crops — as much as 70% of the world’s water is used for agriculture — and the planet may be at a tipping point.

No single change in the approach to feeding the world will shift the balance by itself.

Hydroponic farming is “a solution,” said Alexander Olesen, a cofounder of Babylon Micro farms in Virginia, which uses its small growing units to help corporate cafeterias, senior living centres, hotels and resorts provide fresh produce, “but they are not the solution.”

Babylon Micro farms in Virginia provides fresh produce for corporate cafeterias, senior living centers, hotels and resorts.

(Babylon Micro-Farms Inc.)

For one thing, not all crops are viable. Nearly everything can be grown using hydroponics but some crops, such as wheat, some root vegetables (including carrots, beets and onions), and melons and vining crops, are impractical. The easiest crops to grow: leafy greens, including spinach and lettuce; microgreens; herbs such as basil, cilantro, oregano and marjoram; some vegetables, such as green peppers and cucumbers; and certain fruits, including tomatoes and strawberries.

Although hydroponic farming means crops grow faster — thus increasing output — the process comes with a significant carbon footprint, according to “The Promise of Urban Agriculture,” a report by the Department of Agriculture/Agricultural Marketing Service and Cornell University Small Farms Program. Lights generate heat, which then must be removed by cooling. Lettuce grown in traditional greenhouses is far cheaper, the report says.

If these crops can be grown traditionally — in a garden or in a commercial field — why bother with growing systems that are less intuitive than planting seeds, watering and harvesting? Among the reasons:

Climate control: Such indoor agriculture generally means consistent light, temperatures, nutrients and moisture for crops no longer held hostage by nature’s cycles of drought, storms and seasons.

Environmental friendliness: Pesticides generally aren’t used and thus create no harmful runoff, unlike field-grown crops.

Productivity: Leafy greens tend to be cool-season crops, but in a controlled environment, it’s an any-time-of-year crop without the worry of depleting the soil because of overuse because, of course, there is no soil.

Use of space: AeroFarms, a former steel mill in Newark, N.J., boasts that it can produce 2 million pounds of food each year in its 70,000 square feet, or about 1.3 acres. California’s Monterey County, by contrast, uses nearly 59,000 acres — out of 24.3 million acres statewide of ranches and farms — to grow its No. 1 crop, which is leaf lettuce valued at $840.6 million, its 2019 crop report showed.

AeroFarms in Newark, N.J. boasts it can produce 2 million pounds of food each year at its 70,000-square-foot facility in Newark, N.J.

(AeroFarms)

Food safety: In E. coli outbreaks in late October and early November of last year, fingers pointed to romaine lettuce that sickened consumers in 19 states, including California. In November and December of 2019, three other outbreaks of the bacterial illness were traced to California’s Salinas Valley. A Food and Drug Administration study, released in May with results from that trio of outbreaks, “suggest(s) that a potential contributing factor has been the proximity of cattle,” whose faeces often contain the bacteria and can find its way into water systems.

That’s less of an issue with crops in controlled-environment agriculture, said Alex Tyink, president of Fork Farms of Green Bay, Wis., which produces growing systems suitable for homes and schools.

“In the field, you can’t control what goes where,” he said, including wildlife, livestock or even birds that may find their way into an open growing area.

And as for workers, “The human safety approaches that we take [with] people in our farm make it hard for them to contaminate even if they wanted to,” he said.

“Before people walk in, they gown up, put their hair in nets, beards in nets, put on eye covering and bootie covers for their shoes, then walk through a water bath.”

None of the statistics matter, though, unless the quality of soil-less crops matches or exceeds that produced traditionally.

Not a contest, new-age growers say. Flavors of leafy greens, for example, tend to be more detectable and, in some cases, more intense.

So much so that when AeroFarms introduced its baby kale in a New York grocery store, Marc Oshima, a cofounder and chief marketing officer, says he saw a woman do what he called a “happy dance” when she sampled this superfood. The version that AeroFarms produces is lighter and has a “sweet finish,” Oshima said, compared with adult kale grown in traditional ways that some say make the superfood fibrous and bitter.

Storey, the cofounder of Plenty, judged his Crispy Lettuce mix successful when his children got into a “rolling-on-the-floor fistfight” over a package of it.

Some credit for that flavor can be attributed to the time from harvest to market. Arizona and California are the top lettuce producers in the U.S., but by the time the greens get to other parts of the country, they have lost some of their oomph. AeroFarms and Plenty, for instance, distribute their commercial products to nearby grocery stores in New York and the Bay Area, respectively, where their time to market is significantly reduced.

And when was the last time you had a salad on an aeroplane flight that didn’t taste like water gone bad? Before the pandemic constricted airline traffic, AeroFarms was growing greens to be served to passengers on Singapore Airlines flights from New York’s JFK. The fresh vegetables travelled just five miles from the warehouse to Singapore’s catering kitchen, a new twist on the farm to (tray) tabletop.

Because the turnaround from harvest to market is shorter, Storey said his products often last several weeks when refrigerated.

Leafy green vegetables are grown by AeroFarms.

(Emily Hawkes)

And perhaps best of all? Growers say that because the greens have a flavorsome peppery, some like mustard — salad dressing may be optional, perhaps dispossessed in favor of the flavor of naked greens.

Getting consumers interested in vegetables and incorporating those foods into their diets is especially important, growers say, because of skyrocketing rates of obesity, diabetes and heart disease, especially for populations in food deserts.

Tyink grew up in rural Wisconsin but moved to New York to pursue a career in opera. By chance, he sampled some produce from a rooftop garden that he called life-altering. “My eating habits changed because [the greens] changed my emotional connection to food,” he said.

His exposure to homelessness and poverty on the streets of New York also focused his attention on what people consume and why. Price and convenience often drive bad food decisions and unhealthy habits.

Young farmers in training can help change those habits; some of Fork Farms’ systems are used in schools and other nonprofit organizations for children. Kids become accidental ambassadors for the nutrient-rich crops, and the fruits of their labors go to school cafeterias or to local food distribution centres in their communities.

“I really think when you lose fresh, locally produced food, you lose something of [the] culture,” said Lee Altier, professor of horticulture at Chico State University, where he has been working with students to develop its aquaponics program. “I think it is so important when communities have an awareness … that this is for their social integrity.”

As for the future, much still needs to be done to put such products in the right hands at the right time. That requires investment, innovation and technology to perfect the systems and keep costs under control, never mind persuading buyers and consumers that food that’s healthy can also be satisfying.

Is it a puzzle worth solving? Storey thinks so. “I want to live in a world where [we create] delicious, amazing things,” he said, “knowing that they are not coming at a cost that we don’t want to pay.”

About Catharine Hamm

Catharine Hamm is the former Travel editor for the Los Angeles Times and became a special contributor in June 2020. She was born in Syracuse, N.Y., to a peripatetic family whose stops included Washington, D.C.; Honolulu; and Manila. Her varied media career has taken her from McPherson, Kan., to Kansas City, Mo., San Bernardino, Salinas and L.A. Hamm has twice received individual Lowell Thomas Awards, and the Travel section has been recognized seven times during her tenure as editor. Her favourite place? Always where she’s going next.

IDTechEx Identifies Innovative Companies Changing The Face of Vertical Farming

Vertical farming, the practice of growing crops indoors under tightly controlled conditions, is continuing to expand rapidly

Sep 02, 2020

BOSTON, Sept. 2, 2020,/PRNewswire/ -- Vertical farming, the practice of growing crops indoors under tightly controlled conditions, is continuing to expand rapidly. By using LED lighting tailored to the exact needs of the crop, alongside advanced hydroponic growing systems, and growing crops in vertically stacked trays, vertical farms can achieve yields hundreds of times higher than the same area of traditional farmland.