Welcome to iGrow News, Your Source for the World of Indoor Vertical Farming

EAT LOCAL + HEALTHIER + GREENER + FRESHER

As Americans increasingly reject cheap, processed food and embrace high-quality, responsibly-sourced nutrition, hyper-local farming is having a moment

EAT LOCAL

EAT FRESHER

EAT HEALTHIER

EAT GREENER

Photo: AeroFarms

image taken by photographer Holly Challinor, Jones Food Company Ltd.

HELIPONIX

TOP USAGE OF FARMLAND BY STATE

ALL OF THE AG LAND IN THE WORLD

AmplifiedAg Inc. Completes $40MM In Capital Raise, Expanding Global Technologies And Vertical Roots Indoor Farms Across The Southeast

AmplifiedAg Inc.™, fast-growing agtech industry leader on a mission to provide global access to safe food, announced today that the company has completed $40 million in equity financing.

August 9, 2021

CHARLESTON, S.C., /PRNewswire/ -- AmplifiedAg Inc.™, fast-growing agtech industry leader on a mission to provide global access to safe food, announced today that the company has completed $40 million in equity financing. The funding will support the continued expansion of the company's world-leading hydroponic container farm, Vertical Roots and further development of the company's holistic operating system, AmpEDGE™, which uniquely combines environment monitoring and controls with business operations for end-to-end indoor farm management.

"Our demonstrated ability to scale our indoor farms and technology is leading to discussions with strategic and financial partners, and we expect to consummate additional financing later this year to further accelerate Vertical Roots' presence across the Country," said Don Taylor, CEO of AmplifiedAg.

Vertical Roots' rapid success exemplifies the time, profitability, operational growth efficiency, and superior product quality AmplifiedAg farms and technology achieve. In less than four years, Vertical Roots has grown to be the largest hydroponic container farm in the world growing multiple varieties of mature, fresh leafy greens. The company currently operates three farm sites in Charleston, S.C., Columbia, S.C., and Atlanta, Ga. with produce available at 1,700 major grocery stores across 12 states including retailers such as Publix, Harris Teeter and Whole Foods, as well as schools, universities, and restaurants.

The current round of funding will support the installation of farms in north and central Florida, extending Vertical Roots' dominant position as the leading CEA and vertical farming business in the southeast market.

AmplifiedAg implements a distinctive strategy to operate Vertical Roots farms directly at distribution facilities, eliminating a massive leg of produce transportation in order to reduce emissions and provide communities with fresh, locally grown produce. Vertical Roots current focus is on nutritious, mature lettuce varieties that are celebrated for their flavor, freshness and being 100% pesticide-free.

Taylor added, "We're dually focused to deploy Vertical Roots farms across the country as close to the point of consumption as possible, while advancing and expanding AmplifiedAg's global network of proven technologies and farms to others in the CEA industry."

About AmplifiedAg, Inc.

AmplifiedAg, Inc.™ is an agtech industry visionary on a mission to provide global access to safe food. The company manufactures indoor vertical container farms, hydroponic systems, and disruptive seed-to-sale SaaS-based technologies. AmplifiedAg provides holistic indoor farming solutions to sustainably grow and distribute food anywhere in the world.

AmplifiedAg owns and operates Vertical Roots, the largest hydroponic container farm in the World with produce in over 1,700 grocery stores nationwide. Learn more at www.amplifiedaginc.com. Growing Food for a Growing World.

The Farmory: Is Indoor Fish Farming A Viable Way of Tackling Declining Fish Populations?

The Farmory, an urban farming nonprofit, is the only indoor fish hatchery in Wisconsin. The nonprofit focuses on sustainable growing practices for both greens and gills

By John McCracken

August 6, 2021

For decades, Green Bay Wisconsin National Guardsmen stored munitions and trained new recruits in a stucco-clad, Chicago Street building built in 1918.

Now, the building is home to hundreds of fish babies.

The Farmory, an urban farming nonprofit, is the only indoor fish hatchery in Wisconsin. The nonprofit focuses on sustainable growing practices for both greens and gills. When it was founded in 2016, the focus was on growing produce indoors using aquaponic systems to both teach and provide a new source of food in the state’s harsh winters. As the program grew, they introduced percids such as yellow perch, walleye and sauger into their arsenal.

Executive director Claire Thompson said most aquaponic operations use tilapia because of its cheap price point due to massive global exports.

“There’s also some perceptions about (tilapia) here, especially in the Midwest, that it’s not as good of a fish,” said Thompson.

The Farmory settled on growing yellow perch to complement their vegetable production because of its beloved place on Wisconsin plates and its volatile population over the years.

They soon discovered a problem. No one was growing perch indoors yet.

“That led us down the road toward ‘more research needs to be done,’” said Thompson. “We need to be able to set up our own hatchery to produce a steady and consistent supply of year-round, feed-trained fingerlings that are grown from the egg in an indoor environment.”

In the bottom level of The Farmory, budding fish are separated by a bio-secure room and health protocols. Volunteers and entrepreneurial and technician students take turns monitoring temperatures in the complex hatchery. Each separate tank mirrors life cycles and seasons of growing yellow perch and their walleye cousins. During a late June visit, an insulated tank is sealed shut and a quick peak inside shows adolescent perch huddled together for warmth. The fish don’t know about the humid Midwest summer outside because their faux-winter hovers around a chilly 30 degrees Fahrenheit.

The Farmory (Photo Credit: John McCracken for Great Lakes Now)

Schools in session

Being a nonprofit allows The Farmory to not have to worry about mass production or profit margins as much as for-profit hatcheries that already exist on slim margins. Instead, they worry about being a stepping-stone for future fish farmers.

The Farmory offers 12-week technical programs that provide hands-on trainings and lectures from researchers and ichthyologists. Since The Farmory launched both pathway programs in 2020, they have had 34 graduating students.

Thompson said that for students interested in aquaculture there are only two options in the state. Students can go to a four-year program at either University of Wisconsin-Stevens Point or UW-Milwaukee.

For the students coming through The Farmory’s doors—who range from recent high school graduates to retirees—fish-wrangling fares better than test-taking in the growing industry.

“There’s a lot of jobs in the aquaculture industry that don’t require a four-year degree,” Thompson said. “You have to have people with basic technical skills.”

The Farmory’s students are much like their customers. Their interest and aspiration range from basement or backyard hobby farming to scalable commercial production. The Farmory grows fingerling perch until they are between 2 to 4 inches and then customers take them to grow them to adult size for spawning or frying.

In 2020, they had 60 customers and sold fish across state lines to Michigan, Ohio and Minnesota. Thompson said most customers bought between 100 and 500 fish, but a handful purchased thousands of perch pounds to fuel their own commercial fishery endeavors.

“We want to be able to secure a local food supply. We also want to teach people about aquaculture as a viable business opportunity,” said Thompson.

The Farmory (Photo Credit: John McCracken for Great Lakes Now)

Problems come with being new

Being the only indoor perch hatchery comes with its challenges though.

The COVID-19 pandemic hindered The Farmory’s first hatching year. They weren’t able to get brood stock up to full capacity due to supply-chain complications. The urban farm is working on getting their population to a sustainable level.

Additionally, Thompson said that there is a lack of research and applied standards when it comes to growing perch indoors.

“It’s not like any other agricultural commodity product like dairy or chickens,” said Thompson.

Thompson said yellow perch have an innate biology barrier, where survival is harder to come by—something that is important for an organization focused on producing and spreading young perch. Perch also don’t have a set diet. As of now, The Farmory feeds their perch a trout diet, which Thompson said is slightly fattier.

“We have to find a way to get enough people into the business of (indoor fisheries) to we can work with feed companies to be able to develop affordable feed,” said Thompson.

On the other end of the process chain, Thompson said a decline in the perch population since the booming years of yore has led to a lack of skilled fish processers and sustainable operations.

“Because of the decline of Great Lakes commercial fishing, we’ve also seen a decline in processors to clean and process fish,” said Thompson.

Smaller, sustainable scale

Sharon Moen echoed a lot of Thompson’s observations of the industry at large.

Moen is an outreach specialist with Wisconsin Sea Grant— a statewide research and stewardship program dedicated to the resources of Great Lakes—in charge of the Eat Wisconsin Fish Initiative. Eat Wisconsin Fish was established in 2013 to become a hub for information and resources for the state’s fish producers and consumers.

Moen said the many people in the industry believe the future of fish farming is heading indoors because of the effects of climate change on the industry, its habitats and the fish themselves.

“Algae blooms and invasive species can’t get into the water,” Moen said of indoor, contained aquaculture systems.

Moen also said that the way consumers and producers import and export massive numbers of commodities has a continued effect on the planet due to gas emission.

“We have to stop carting things around the globe in order to really truly cut down on carbon emissions,” said Moen. “We need to learn to eat and grow our food more locally.”

In the past year, Moen observed how breaks in the supply chain—caused by global catastrophe such as the COVID-19 pandemic—make everyone and every supplier vulnerable. Just as the majority of The Farmory’s students are scaling down, many suppliers are focused on local, small-scale consumption.

“I think most (fisheries) are very modest people raising for their local community consumption,” said Moen.

Moen said to alleviate stress on perch’s floundering population and high price point – which she observed at upwards of $20 a pound last year – consumers could switch to a more abundant species like whitefish.

Both Moen and Thompson pointed out that adjusting to problems in the industry, whether you’re growing fish in a bedroom tank or in cavernous outdoor ponds, takes agility and a love for fish.

“It’s like gardening,” Moen said. “You have to have a knack for it and take care of what you’re growing.”

European Pension Managers Go Big For Indoor Ag as Equilibrium Closes $1.1bn CEA Fund

Equilibrium Capital, a US-based private sustainable finance and ESG funds manager, has closed its second indoor ag fund on just over $1 billion – well beyond its $500 million target.

By Louisa Burwood-Taylor

July 8, 2021

Equilibrium Capital, a US-based private sustainable finance and ESG funds manager, has closed its second indoor ag fund on just over $1 billion – well beyond its $500 million target.

Controlled Environment Foods Fund II (CEFF II) raised $1.02 billion from a group of institutional investors, mostly pension funds, with a strong showing from Europe, according to Equilibrium CEO Dave Chen. Sweden’s AP4 was one of five anchor investors that took over half of the total fund alongside two large UK pension managers, he added.

CEFF II will invest in high-tech greenhouses, indoor, vertical farms, and other sectors that need controlled environment agriculture (CEA) facilities such as alternative proteins and aquaculture.

“The strong investor demand reflects a drive to real assets” and sustainability by large institutional investors, combined with an “interest in agriculture and food systems,” Chen told AFN.

“There is a sense that ag is going through several simultaneous disruptions and that creates an opportunity.”

A press release announcing the fund closing states that investors and retailers “are increasingly looking for more sustainable, and less volatile, ways to invest in and scale agriculture.

“CEA shifts agriculture from a land-centered industry where the land, geography, and weather determines what can grow, into a climate-resilient industry that can now focus on the consumer’s demand for the fresh, safe, and regional fruits and vegetables they want to eat,” it continues.

For Portland, Oregon-based Equilibrium — which has funds across environmental and sustainability verticals including ‘green’ real estate, water, wastewater, and outdoor agricultural production — CEA is a compelling investment opportunity for its ability to dramatically increase the productivity of food production “per unit of resource input [and] land use,” said Chen.

“The ability to ride a tech innovation curve, locate farms regionally for quality and resilience, adapt to climate change, and capture demand from retailers and food service” also make it attractive, he added.

Asked where he expects the market share for CEA-produced food to be in five years, he estimated upwards of 30-50%. “Tomatoes are already there,” he said.

Equilibrium is predominantly a real assets investor, owning or investing in indoor farming facilities and greenhouses, but it also buys equity stakes in operating companies. CEFF II will invest between $10 million and $125 million per deal, primarily across North America. It has made three investments to date — two in the US and one in Mexico — mostly in mature high-wire crops like tomatoes, peppers, and cucumbers, as well as the emerging categories of leafy greens and berries.

Equilibrium’s $336 million Fund I portfolio includes indoor ag companies such as AppHarvest — which went public earlier this year via a SPAC merger — Revol Greens, and Little Leaf Farms.

Indoor Ag Sci Cafe Talks About Propagation And Transplants

This presentation ‘Precision Indoor Propagation for High Quality Transplants’ was given by Dr. Ricardo Hernandez (North Carolina State University) during our 32nd cafe forum on August 3rd, 2021

August 5, 2021

This presentation ‘Precision Indoor Propagation for High Quality Transplants’ was given by Dr. Ricardo Hernandez (North Carolina State University) during our 32nd cafe forum on August 3rd, 2021.

Upcoming Cafes:

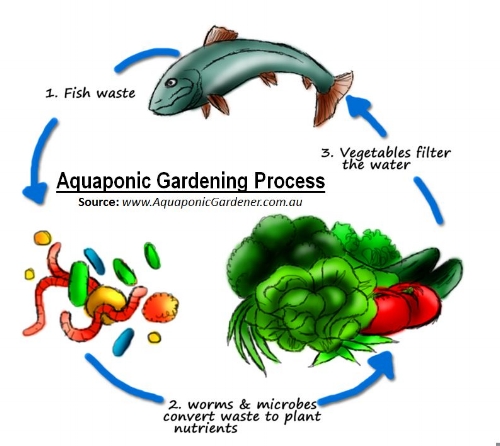

September 21st (Tuesday), 11AM Eastern – ‘Introduction to Aquaponics‘ by Dr. Paul Brown and Dr. Cary Mitchell (Purdue University)

October 26th (Tuesday), 11AM Eastern – ‘Vertical Farming – Past, Present and Future‘ by Robert Colangelo (Green Sense Farms)

November TBA

December 7th (Tuesday), 11AM Eastern – ‘Plant-Made Pharmaceuticals under Controlled Environment‘ by Dr. Nobuyuki Matoba (University of Louisville)

Interested in giving a talk to share your thoughts and experiences? Please contact Chieri Kubota

AppHarvest Names Julie Nelson EVP, Operations to Build Industry-Leading Manufacturing and Supply Chain Capabilities and Drive Performance Across Network of Farms

AppHarvest to leverage Nelson’s proven experience at PepsiCo, McKinsey to drive productivity across the company’s network of high-tech indoor farms and optimize operations to support profitable growth

August 5, 2021

AppHarvest to leverage Nelson’s proven experience at PepsiCo, McKinsey to drive productivity across the company’s network of high-tech indoor farms and optimize operations to support profitable growth

MOREHEAD, Ky., Aug. 05, 2021 (GLOBE NEWSWIRE) -- AgTech leader AppHarvest (NASDAQ: APPH, APPHW), a public benefit company and certified B Corporation focused on farming more sustainably using up to 90% less water than open-field agriculture and only recycled rainwater, has named Julie Nelson its executive vice president, operations. Nelson will lead efforts to scale AppHarvest’s network of farms and to build manufacturing and supply chain capability to ensure efficient delivery of consistent, high-quality products to major grocers and restaurants.

“Julie’s deep experience optimizing complex manufacturing and distribution networks for major consumer goods companies and her proven ability to drive productivity across the supply chain will help us to deliver improved profitability as we scale,” said AppHarvest President David Lee.

Nelson will play an integral role as an executive management committee member, reporting to President David Lee, and will aid in developing company strategy, establishing operations and driving efficiency to reach productivity and cost goals while ensuring quality and customer satisfaction.

“Julie has battleground-tested experience in scaling operations across sites,” said AppHarvest Founder & CEO Jonathan Webb. “Her recent focus on improving sustainability in the food and beverage supply chain by reducing food waste, energy consumption and greenhouse gas emissions makes her a natural fit at AppHarvest.”

Nelson joins AppHarvest most recently from McKinsey & Company, following a long tenure with PepsiCo, where she led supply chain teams in the North American beverage business and the global operations team. Her focus areas included network optimization, scaling new digital technologies and end-to-end value chain productivity.

“AppHarvest’s mission aligns with my personal values,” Nelson said. “AppHarvest’s vision of combining the best that nature offers boosted with world-class technology to sustainably and affordably grow nutritious fruits and vegetables is inspiring, and I look forward to building a best-in-class operational team in support of this mission to build a climate-resilient food supply.”

Nelson holds a bachelor of science in economics from the Wharton School of the University of Pennsylvania and an MBA from Harvard Business School. She is an advisory council member for the West Virginia University Global Supply Chain Management Program.

About AppHarvest

AppHarvest is an applied technology company in Appalachia developing and operating some of the world’s largest high-tech indoor farms, designed to grow non-GMO, chemical pesticide-free produce, using up to 90 percent less water than open-field agriculture and only recycled rainwater while producing yields up to 30 times that of traditional agriculture on the same amount of land without agricultural runoff. The company combines the best that nature offers boosted with world-class technology including artificial intelligence and robotics to improve access for all to nutritious food, farming more sustainably, building a domestic food supply, and increasing investment in Appalachia. The company’s 60-acre Morehead, Ky. facility is among the largest indoor farms in the U.S. For more information, visit https://www.appharvest.com/.

MEDIA CONTACTS: Travis Parman, Travis.Parman@appharvest.com;

Blair Carpenter, Blair.Carpenter@appharvest.com

IMAGE/VIDEO GALLERY: Available here

Lead Photo: Julie Nelson will be joining AppHarvest as its executive vice president, operations.

Infarm’s Hamilton Growing Facility is Expanding to Become its Largest Vertical Farm in North America

Greens grown at an indoor farm right here in Hamilton are about to become more accessible at area grocery stores, following an expansion of Infarm’s vertical growing centre.

By Jeremey Kemeny

July 27, 2021

Greens grown at an indoor farm right here in Hamilton are about to become more accessible at area grocery stores, following an expansion of Infarm’s vertical growing centre.

The company’s facility near the airport is set to dramatically grow over the next several quarters, a spokesperson for the company said.

It’s part of a national expansion, following a deal strengthening Infarm’s relationship with grocery store chain Sobeys Inc. That deal expands the company’s reach to grocery stores in all ten Canadian provinces.

Infarm moved into its facility on Aeropark Boulevard, off Upper James Street, in the last quarter of 2020, said Infarm global communications director Emmanuel Evita.

The Hamilton facility is expected to be Infarm’s largest growing centre in North America, following the expansion, with a growing capacity of 37,000 square feet.

Founded in Berlin, Germany, in 2013, Infarm touts its advancement of modular farms, allowing for growing leaf vegetables in any available space.

In a video, co-founder Osnat Michaeli lauds the efficiency of the vertical growing technology and food waste reduction by farming in proximity to where the food is consumed.

Infarm Co-founder and Chief Brand Officer Osnat Michaeli explains how we're building a global network of vertical farms to grow and distribute fresh produce in cities. Infarm’s modular, cloud-connected system enable us to scale and deploy urban farms fast, growing tasty and nutritious produce more sustainably than traditional agriculture. Our modular technology is at the core of a sustainable global urban farming network that is up to 400 times more efficient than soil-based farming, using 95% less land, 95% less water, and requires 90% fewer food miles to get to consumers.

Infarm’s hyperlocal approach includes growing facilities in stores, restaurants or distribution centres.

Here in Hamilton, they plan to transform their warehouse farm into a high-yield facility.

Each 10-metre-high module at the Hamilton facility will “take just six weeks to build and (yield) a crop-equivalent of up to 10,000 square metres of farmland,” Evita said.

He said they’re expecting the production capacity and the number of locations served by the Hamilton facility to greatly expand, following the outfitting of the facility.

Evita says Infarm expects to expand its Canadian workforce by 50 per cent before the end of the year. It’s not yet known how many of those employees will be in Hamilton.

“Infarm is already offering fresh, local produce grown directly in Sobeys retailers or supplied from our Hamilton location,” Evita says, “with much more to come.”

Converting Urban Areas Into Indoor Pesticide-Free Farms For Year-Round Food

Indoor farming addresses the concern of limited arable land and water wastage. In vertical farming, the need for land can be reduced by a hundred-fold, and by recirculating and reusing water, an average of 95% less water is required for growing the same crops when compared to outdoor farming

By Li Yap

July 14, 2021

Concerns With Traditional Farming

Traditional farms typically rely on herbicides, pesticides and fertilizers to grow crops, which can pollute the environment if used in excess. Up to 98% of a chemical spray will bounce off a crop instead of staying on the plant, resulting in chemicals accumulating in the soil and, eventually, waterways.

Biodiversity loss is another concern of conventional farming as the conversion of wild spaces to farmland has resulted in less space for wild plants and animals to live in. With the global population predicted to reach 9.7 billion by 2050, the agriculture industry is under pressure to scale up to meet these demands, which could potentially affect the natural environment further if nothing is done to rethink current farming practices.

With 40% of available global land already occupied by fields of crops and pastures for animals, it would be difficult to completely eliminate the impact that farms have on the natural environment. However, part of the answer could lie in indoor farming where growing conditions can be better managed, reducing the environmental impact of growing produce.

Indoor Farming Technology Market

The indoor farming technology market was valued at $14.5 billion in 2020 and is projected to reach $24.8 billion by 2026.

The contained facilities used in indoor farming allow farmers to better control and optimize growing conditions. This results in higher yields compared to traditional farming methods whilst using less land area. For example, the average yield of tomatoes grown using traditional methods was reported in 2016 to be 1.85 pounds per square foot, while the average yield of tomatoes grown from greenhouse hydroponics was 10.59 pounds per square foot. By increasing the growing area by stacking additional planting layers, the overall crop yield can be increased.

Indoor farming addresses the concern of limited arable land and water wastage. In vertical farming, the need for land can be reduced by a hundred-fold, and by recirculating and reusing water, an average of 95% less water is required for growing the same crops when compared to outdoor farming.

Vertical farming is one of the techniques used to grow crops within indoor environments. By using artificial light and vertical growing systems such as aeroponics, aquaponics and hydroponics, crops such as kale, lettuce, strawberries and herbs can be grown within a clinically clean indoor system without the need for soil, sunlight and pesticides. This technology allows vertical farms to be set up close to populous areas or urban hubs, where harvests can be distributed locally.

80 Acres Farms

80 Acres Farms operates vertical farms in eight locations across four states. Its farms produce crops using zero pesticides and consume 97% less water compared to traditional farms.

Using 100% renewable energy and being completely indoors, 80 Acres’ operation is capable of producing various crop varieties all year without the need to rely on favorable weather.

Sophisticated technologies, including AI sensors, are incorporated into its operation to ensure that growth environments are optimized according to the plants’ genetics and that harvests are at the peak of ripeness. By relying on a smaller delivery radius, customers are able to access the produce within a day of picking.

“80 Acres' farms are, on average, 300 to 400 times more productive than field farming”, says co-founder Mike Zelkind. This is due to the vertical structures used for growing produce, which allows room for more crops in less space as well as faster-growing produce.

Current Limitations of Indoor Farming

Apart from the high energy costs associated with operating vertical farms, there are also high investment costs for urban land and for the technologies and devices needed to carefully control and monitor the growing environment – these include aspects such as temperature, lighting, and pollination.

The high initial investment compared with traditional farming is a drawback for indoor farms, but this also invites the opportunity for innovation and the development of more cost-effective technologies.

Transforming Agriculture for the Future

Transforming farming in a way that does not affect the natural environment will be no small task, given the sheer scale of the world’s agriculture. With a growing demand for food, there is an ever-increasing pressure for high-yielding and sustainable farming techniques.

In addition to being a great use of spaces not traditionally utilized for agriculture, the high yields of pesticide-free indoor farms show great promise. Although indoor farming is unlikely to completely replace traditional field farming right now, it still has the potential to answer, at least in part, the question about food security in the years to come.

Lead Photo: With the ever-growing demand for food placing increased pressure on the Earth’s resources, innovators are re-examining the fundamentals of farming to create a new and sustainable food system. With the hopes of potentially transforming global food systems, many emerging start-ups have identified urban indoor farming as a viable alternative to conventional farming.

mage Credit: Nikolay_E/Shutterstock.com

Video Credit: 80 Acres Farms/YouTube.com

Bringing Energy Management And Automation Opportunities To Indoor Farming

“We can’t be the most sustainable company in the world if we don’t work on the world’s biggest sustainability challenges,” says Travis Graham, international account manager at Schneider Electric. Schneider provides a vast array of digital technologies to multiple sectors, including horticulture

By Rebekka Boekhout

July 14, 2021

“We can’t be the most sustainable company in the world if we don’t work on the world’s biggest sustainability challenges,” says Travis Graham, international account manager at Schneider Electric. Schneider provides a vast array of digital technologies to multiple sectors, including horticulture. However, the company recently decided to strategically address the indoor farming segment and partner with growers to improve energy efficiencies within the sector.

As a global specialist in energy management and automation, Schneider’s goal is to empower the global population to improve their energy and resource use efficiency. This purpose, coined “Life is On”, aligns strongly with the spirit of indoor agriculture whose goal is to produce food and medicinal crops in an environmentally sustainable manner.

Named the world’s most sustainable company in 2021 by Corporate Knights, Schneider holds sustainability at its core and uses its century-long experience in energy management to help growers improve the energy efficiency of their facilities.

Read the rest of the article here

For more information:

Schneider Electric

www.se.com

Indoor Farming Is In Growth Mode

The future of indoor farming, including vertical farming, has nowhere to go but up. With parallel and perhaps inevitably colliding trends of sustainability, plant-based eating, food safety and labor-saving agricultural practices, produce grown in controlled environments is likely to become much more common in grocery stores.

By Lynn Petrak

July 9, 2021

The future of indoor farming, including vertical farming, has nowhere to go but up. With parallel and perhaps inevitably colliding trends of sustainability, plant-based eating, food safety and labor-saving agricultural practices, produce grown in controlled environments is likely to become much more common in grocery stores.

As a testament to the sunny future of the ag tech niche, the U.S. Department of Agriculture started a new Office of Urban Agriculture and Innovative Production last year. More than $3 million in initial grants were made available through that department in 2020.

Prognosticators have weighed in on a future of food that includes strategically located indoor farms throughout the country. In a report released late last year, Allied Market Research, whose Americas office is in Portland, Ore., projected that the global vertical-farming industry is expected to reach $1.38 billion by 2027, with a compound annual growth rate (CAGR) of 26.2% from 2021 to 2027.

Several grocers are already buying into this type of produce supply. Earlier this year, The Kroger Co., based in Cincinnati, began sourcing fresh produce from Hamilton, Ohio-based indoor grower 80 Acres Farms for the retailer’s stores in Ohio, Indiana and Kentucky. In 2020, Kroger partnered with German startup Infarm to add modular vertical farms to two of its Quality Food Centers in the Seattle area.

Also last year, Publix Super Markets said that it will invest more in hydroponic produce and added a new on-site trailer farm from a local hydroponic grower to its GreenWise Market store in the grocer’s hometown of Lakeland, Fla. Boise, Idaho-based Albertsons Cos. has collaborated with South San Francisco, Calif.-based Plenty and with Bowery Farming, based in New York, to provide its shoppers with fresh produce grown indoors. Natural and organic retailer Whole Foods Market, based in Austin, Texas, recently added a mini-farm from New York-based Farm.One to one of its Big Apple stores to provide herbs for prepared pizzas and drinks. In addition to these and other large grocery players, smaller chains and independents have teamed up with various greenhouses and growing operations near their locations.

Consumers have expressed their opinions about produce grown indoors. According to the 2021 “Power of Produce” report published by Arlington, Va.-based FMI – The Food Industry Association, and conducted by San Antonio-based 210 Analytics, 43% of shoppers don’t have a preference for produce coming from indoor versus outdoor farms. Those most likely to prefer indoor growing include urbanites, consumers with above-average spend per person, members of the Generation Z age demographic, higher-income households, core value-added shoppers, organic produce buyers and men. Those more likely to prefer outdoor-grown produce include consumers in rural areas and conventional produce buyers, the report found.

AeroFarms uses aeroponic methods to grow healthy plants, using up to 95% less water and no pesticides.

Greener Pastures

One of the biggest drivers of the move to produce more food in indoor-farming facilities is sustainability. From an environmental standpoint, indoor-grown produce may be part choice, part necessity, depending on the area and the circumstances.

Necessity is born of conditions wrought by continual weather extremes that are often attributed to a changing climate. Unusual weather patterns resulting in droughts, floods, storm damage and harmful freezes take a toll on traditional farms and on the farmers who grow fresh fruits and vegetables.

Weather extremes have always happened, but are becoming more frequent. For example, coming off last summer’s devastating derecho event, a drought that began in late 2020 in Iowa and has continued through early summer is stressing that state’s corn and soybean crops. Earlier this year, rare heavy snow, ice and frigid temperatures in Texas hurt winter wheat and some citrus crops.

At the same time, there’s an overall push to produce food in a more sustainable way. More than two-thirds (64%) of American consumers say that they’re willing to pay a premium for environmentally friendly products. “There is a trend – not a fad – of consumers who appreciate the benefit of getting produce soon after it’s harvested,” says David Rosenberg, co-founder and CEO of vertical-farming leader AeroFarms, based in Newark, N.J., “and more and more customers are realizing that they want products with no pesticides, because those are not meant for human beings.”

On the business side, sustainability is a central part of many CPGs’ and grocers’ corporate- responsibility platforms as they pledge to reduce their use of resources like water and energy. Many manufacturers and retailers have also revealed goals to cut down on or eliminate the use of pesticides in their products.

Other Seeds of Change

In addition to the pursuit of sustainable growing practices, other factors are contributing to interest in this method of agriculture. The need to shore up food security in the face of a booming global population and the problem of urban food deserts are notable catalysts. So is consumers’ penchant for eating more fresh plant-based foods, and foods grown in a more sustainable way.

Meanwhile, as evidenced in ubiquitous “Now hiring” signs, it can be tough to find workers to plant, care for and harvest crops. Indoor farms run with several automated controls and tasks are less affected by fluctuations and stresses in the labor market.

The global COVID-19 pandemic also contributed to the acceleration of indoor farming. When some retailers faced supply chain issues and had difficulty sourcing fresh products, they turned to new vendor partners that operated indoor farms with more controlled conditions and inventories. Indoor farms typically can be built faster and are also versatile operations that allow for pivots in the event of changing circumstances.

There are additional practical reasons for sourcing produce from indoor growers. “Right now, retailers want consistency in price, quality and delivery. At its core, we are delivering consistency,” notes Rosenberg, citing other profit-driven benefits such as reduced shrink and spoilage.

Modern indoor farms combine technology and agriculture to provide fresh produce in a more sustainable way.

Indoor-Farm Tour

Generally, plants in indoor-farming facilities are grown in cells stacked for space savings and efficiency. In lieu of the sun, LED lights are used to facilitate growth.

Watering techniques vary. In hydroponic farms, plant roots are placed in nutrient-rich solutions instead of soil. With aeroponics, exposed roots hang down from the plant and receive nutrients via a system that sprays nutrient-filled water.

Indoor farms take different forms in the United States and around the world. Some indoor farms are massive in size and almost industrial in their setup. Others are smaller and hyperlocal, using locations like repurposed shipping containers or greenhouses. Some farms are constructed vertically to minimize the physical footprint or to use existing buildings, while others are more spread out in their design. Farms are being built in urban areas, often in former manufacturing facilities, warehouses or multilevel stores, and in more rural areas, where they are run by longtime family farm owners who are looking for ways to reinvent their businesses in the wake of competition from big farms.

One thing is for sure: There are more of these types of growing operations. AeroFarms is one grower on the march, with a l36,000-square-foot aeroponics farm under construction in Virginia, set to be finished sometime in 2022.

In June, Vertical Roots, a Charleston, S.C.-based hydroponic container farm that’s part of Amplifed Ag, opened its third indoor farm in Atlanta at a facility run by two large produce suppliers in the Southeast. According to the company, the new farm will eliminate the need for transportation to the distributor and will enable produce to be delivered to local customers the same day that it’s harvested.

In mid-June, Morehead, Ky.-based grower AppHarvest revealed that it’s adding two large indoor farms in the Bluegrass State. With a completion date of the end of 2022, the farms will produce non-GMO leafy greens and fruits for shipment to grocers and restaurants.

Also in 2021, Irvington, N.Y.-based BrightFarms opened its newest indoor farm, in Hendersonville, N.C., a 6-acre greenhouse that will deliver to retailers in nearby areas in that state, as well as in South Carolina and Georgia.

Startup Bowery Farms is opening an R&D hub called “Farm X” that will help expand product development. The facility includes a new sensory lab and innovation center.

In another sign of the health of this sector, there’s major seed money – no pun intended – going toward indoor farming. Berlin-based Infarm, for example, is said to be going public following a reported merger with Kernel Group Holdings Inc., of San Francisco. In May, Bowery Farming revealed a new round of funding to the tune of $300 million that lifted the company’s estimated value to about $2.3 billion. Indoor-farming company Gotham Greens, based in Brooklyn, N.Y., revealed $87 million in new funding in December 2020.

While indoor farms are expanding, crops produced in such facilities are expected to grow, too. Most ag tech companies currently produce leafy greens and herbs in hundreds of different varieties. Tomatoes are also grown hydroponically in many places. Better technologies and a greater collective knowledge are spurring innovations in other types of crops grown indoors in an eco-friendlier way. AppHarvest, for its part, is growing strawberries in one of its new locations, and vine crops in another.

Implications for the Retail Produce Section

More and different types of indoor farms are transforming agriculture – and the retail produce department. Since many of these products are packaged on site, supermarket produce sections now feature a greater mix of packaged and bulk items. Offerings like packaged salads and tomatoes also help define and elevate a brand, whether it’s a store brand or a grower brand.

Coming off a year in which consumers prepared more foods and experimented with new products and varieties, several new products grown in indoor-farming facilities have hit the marketplace. Medford, Minn.-based Revol Greens recently rolled out new varieties of chopped romaine salads made with lettuces grown at its indoor farm in its home state. Revolution Farms, in Caledonia, Mich., is launching four new salad mixes. One of Bowery Farming’s latest products is a new Bowery Crispy Leaf Lettuce, deemed to be a “reinvigorated version” of iceberg lettuce. And that’s just the tip of the iceberg (lettuce).

Grocers can merchandise indoor-farmed produce in a creative way to distinguish their offerings and connect with shoppers. “We’ve worked in a process of co-creating with retailers,” observes AeroFarms’ Rosenberg. “It is an opportunity to deliver innovation and excitement for an exciting category.”

Lead Photo: Hydroponic farming company Vertical Roots is growing its footprint with a new indoor lettuce farm in the Atlanta area.

"Central And Eastern Europe Can Be The Powerhouse of Global Food Security"

"Closed-system farming helps tackle the biggest challenges in global food supply security", says Tungsram president & CEO Joerg Bauer

July 6, 2021

"Closed-system farming helps tackle the biggest challenges in global food supply security", says Tungsram president & CEO Joerg Bauer.

Climate change causing extreme weather conditions in certain areas, overpopulation, soil contamination, the depletion of areas suitable for agricultural production, urbanization, and growing demand for quality food all point toward the increasing importance of local indoor farming and urban vertical farms. The world’s population is predicted to reach 9.7 billion by 2050 (2 billion more than today), with most of the growth set to take place in Africa and developing countries where climate change hits the hardest. Moreover, in just 10 years, humanity will need 50% more food than today (calculating with a current annual growth rate of 5%).

"We are convinced that outdoor farming alone will not be able to meet these challenges. The much-needed technological advances of precision agriculture, improved seeds, and irrigation will be needed to counterbalance the adverse impact of climate change alone: innovative solutions designed to ensure food security must complement this huge undertaking. Indoor farming stands out as one of the best-suited solutions," he explains.

"Indoor farms are highly water-efficient installations that take up considerably less space, and are independent from weather conditions and the change of seasons. Paired with other technology-driven solutions, these farms can be the guarantees of basic human wellbeing for billions of people, where basic wellbeing is defined by 2,200 calories of healthy, balanced food intake and 10 liters of water (for drinking, basic hygiene and cooking) per person a day."

Joerg Bauer with Tungsram

The company supplies LED / Vertical Farming solutions

Innovation and investment

However, for this exciting disruptive technology that balances on the thin line between agriculture, industry 4.0, and digital technology to provide real global solutions and be able to produce staple food for the masses, including integrated ecosystems that can also feed animals in a sustainable way, a lot of innovation and investment is necessary. "Humanity will have to embrace sources of food that go beyond the traditional approach, such as algae, bacteria, or insects, which often have a much higher conversion rate of feed intake to edible food. By cleverly combining different elements such as vertical farms, animal husbandry, insects, and fish, we can get very close to a zero-waste cluster with optimal productivity – allowing strategic autonomy even in countries with adverse climatic conditions."

Although Central and Eastern Europe do not typically bear the brunt of the most severe consequences of climate change and food scarcity, an increasing number of European initiatives focus, for example, on the impact of the 24% decline in water sources on the continent in the last few years.

"However, the CEE region could play a much bigger role than simply making the necessary investments to solve its own looming climate problems. I have always looked at the CEE region as a historically well-established bridge connecting Europe with developing countries in need and working closely with North Africa and the Middle East. It is up to the nations of this region, to us, to understand what happens to geopolitical stability if we fail to help these developing countries to deal with all the negative, sometimes catastrophic consequences of climate change and fast population growth. In addition to being our basic social responsibility and humanitarian obligation to offset these effects, it is also in our very own interest to act. Innovation is needed to propel sustainable food production forward and end hunger in the world," Joerg adds.

"Central and Eastern Europe’s commitment therefore should be to become a global food security powerhouse that develops and starts scaling the solutions, which will allow the citizens of developing countries to live a sustainable and worthwhile life in their home regions."

What should governments and businesses in the region do to achieve this?

"They should acknowledge that the CEE region could potentially play a significant role in these solutions and provide funding for research and innovation to scale food security. By doing so, we would all be working to make the world more livable and we would physically be sowing the seeds of human happiness."

Written by Joerg Bauer President & CEO of Tungsram, originally published in Globsec Disruptive Tech Trends in CEE

For more information:

Tungsram

Keith Thomas, Commercial Leader

keith.thomas2@tungsram.com

agritech.tungsram.com

Crowdfunding Developers of Herb Tower Succeed

In recent weeks, the entrepreneurs of Local Indoor Farming (LIF) ran a crowdfunding campaign to bring their innovative herb tower to the market. Successfully so, because thanks to the support of 88 investors, the herb tower can now be taken into production

July 6, 2021

In recent weeks, the entrepreneurs of Local Indoor Farming (LIF) ran a crowdfunding campaign to bring their innovative herb tower to the market. Successfully so, because thanks to the support of 88 investors, the herb tower can now be taken into production. The first specimens are expected in September.

The entrepreneurs, Harm, Marnix, and Ard-Jan from LIF, want to make high-quality fresh herbs available to everyone. They developed a herbal tower based on the principle of 'Local Indoor Farming'. This tower ensures that herbs can grow under ideal conditions. Because of the flexible design, the tower fits in any interior.

Minimum start-up capital exceeded

The required start capital to take the herbal tower into production was raised through a crowdfunding campaign. A total of 108,000 Euro was raised from 88 investors. The minimum amount of 80,000 Euro has thus been amply exceeded.

Even more important than the initial capital, according to the entrepreneurs, was the attention that they could draw to the herbal tower in this way. Quite a few towers have already been sold and there is also a great deal of interest from the catering and business sectors. This ensures a flying start for the young company.

First units

In the coming weeks, the finishing touches will be added to the production of the first units. They will be delivered from September onwards. The herb tower is offered in combination with a subscription for fresh herbs, so that the customer always has sufficient choice from a diverse range of herbs.

The entrepreneurs have developed a care package for the hotel and catering industry, so that companies do not have to worry about the maintenance of the tower. Customers can also order individual herbs and accessories via their webshop www.lifkruiden.nl.

The entrepreneurs want to stimulate the use of fresh herbs and combat waste. They inform about the use and maintenance of herbs by means of a herbal information package, which can be requested for free via www.lifgroup.nl/kruideninfopakket.

For more information:

Harm Keurhorst

LIF Group

hkeurhorst@lifgroup.nl

www.lifgroup.nl

"For Fruit To Be On The Water For 51 Days And Still Be Sold As A Premium Product Is Unheard Of"

United Exports recently announced that a container of fresh OZblu® blueberries transited the Pacific ocean – from the port of Manzanillo in Mexico to the port of Hong Kong – spending 51 days at sea and arriving fresh and ready for sale in Hong Kong, on 20 May 2021.

Roger Horak - OZblu®

United Exports recently announced that a container of fresh OZblu® blueberries transited the Pacific ocean – from the port of Manzanillo in Mexico to the port of Hong Kong – spending 51 days at sea and arriving fresh and ready for sale in Hong Kong, on 20 May 2021. This was one of several containers sent to Asia from OZblu-Sun Farms’ first harvest in Mexico.

2013 saw the first commercial harvest of OZblu blueberries, the main production area back then was in South Africa with limited production in Australia. These days the blueberries are grown in Peru, Mexico, Chile, US, South Africa, Zambia, Zimbabwe, Morocco, Australia, Portugal and Spain.

The biggest production area is in South Africa followed by Peru then Mexico.

“We have used various productions models comprising both contracted growers and our own production with the expansion very much focused on our own production,” explains Roger Horak, Co-founder of OZblu.

“OZblu varieties are unusual in that they are very adaptable and produce the same fruit in different locations around the world, same yield, crunchiness and taste. South America, especially Mexico fits in well to supply the US and compliments our production there. Peru and Chile have access to China, which South Africa does not have, so it is a case of lining up production with markets to supply the markets 365 days a year. It also spreads risk, for example frost in northern South Africa last year caused a delay of 6-8 weeks in production which needed to be supplied from our other production sites.”

The blueberry category has seen a massive growth in recent years but now according to Roger, it is individual varieties, all markets are differentiating by variety.

“Initially a blueberry was just a blueberry but now there is a huge demand for varietals that deliver flavour and crunch, anyone that thinks growing old open varieties is still an option is dreaming. China is a premium and very discerning market, the EU, UK and US are now all the same. We have not even scratched the surface of what is achievable with proprietary varieties.”

“When we started on this journey, we had our varieties independently tested by Experico which showed that they all could handle 40 days sea freight in normal refrigerated containers, now 96.5% of OZBLU production from South African goes by sea in standard refrigerated containers, versus the rest of the industry only achieving around 60% for sea freight exports. We normally only use refrigerated containers, occasionally CA but nothing else, no modified atmosphere bags or other technology. For fruit to be on the water for 51 days and still be sold as a premium product is unheard of. In this Covid world the importance of being able to ship by sea is essential, as air freight space and rates are very challenging.”

Roger said they are planning a massive ramping up of acreage in the coming years, and intend to double production every two years.

“It is demand driven, the increase will be in the production areas which are stable and attractive for investors and where breeders IP is respected and protected.”

For more information:

Chole Middleton

United Exports

Tel: +27 21 879 2306

chloe@unitedexports.com.au

www.united-exports.com

Publication date: Wed 9 Jun 2021

Author: Nichola McGregor

© FreshPlaza.com

China Introduces Farm Display with Air Purifier

In a shopping mall in Urumqi City, people were attracted by an indoor growing display. While bringing fun to people who are growing, the product can also play a role in purifying the air.

In a shopping mall in Urumqi City, people were attracted by an indoor growing display. "It doesn't only allow you to eat fresh vegetables but it also purifies the air," said the representer.

The indoor farm cabinet is as big as a refrigerator, divided into four layers with LED lights installed on every level. Regardless of the vegetable planting machine occupies less than one square meter, it can grow seven or eight kinds of vegetables at the same time. There's a seedling area for the young plants to grow up, whereas the plants later can be transplanted for the final growing stage. When moved, they can be picked and eaten after 10 days.

The product allows to grow cherry tomatoes, coriander, Chinese cabbage, spinach, and strawberries. While bringing fun to people who are growing, it can also play a role in purifying the air. Especially for families with children, kids can observe the process of seed germination and vegetable growth, and follow the complete growing cycle.

The farm has already formed large-scale planting in the mainlands because of its multi-product growth and quick-growing cycles.

Source: k.sina.com.cn (In Chinese)

Publication date: Wed 9 Jun 2021

Certhon Wraps Up 7th Raspberry Trial Successfully

After successfully growing strawberries in the Certhon Innovation Centre (CIC), the company has decided to take on another trial of growing fruits indoors.

“Raspberry isn’t the first crop that comes to mind when figuring out which crops to grow indoors,” Andrea Huegler, R&D Engineer and Agronomist at Certhon said. “However, we accepted the challenge and decided to go for it as there are a lot of benefits to growing it in a controlled environment.”

After successfully growing strawberries in the Certhon Innovation Centre (CIC), the company has decided to take on another trial of growing fruits indoors. Certhon has been doing lots of research on indoor farming for a long time now. This has allowed them to investigate how to grow more complex crops in a controlled environment without daylight.

Andrea Huegler

Trial results

The main advantage of growing this crop indoors is having higher yields and consistent quality year-round. Certhon sees great opportunities ahead for the crop, due to its premium status and short shelf life. “It makes it a perfect candidate to be grown indoors.” During this trial, common raspberry cultivars were chosen. Certhon used chilled raspberry canes from a propagator, pollination by bumblebees and top and interlighting was used to flourish the crops. The harvesting period comprises 10 weeks, out of a total cultivation cycle of 21 weeks and is expected to end in July 2021.

Cultivation risks

The research was mainly about investigating the right transition of the vegetative state of the crop to the generative state. Andrea says that balancing the climate and light with energy consumption is the trickiest part here. “Ever since the first raspberry trial we’ve been trying to balance out the reduction of energy use, having an X amount of yield at a great quality and extending the harvesting period. Throughout the trials, we have obtained nearly twice as much yield compared to the traditional Dutch polytunnel producers in the summer,” Andrea notes.

However, raspberry cultivation isn’t without challenges. “One of the risks that could come up is growing grey mold,” explains Andrea. “If nectar isn’t removed well from the flower, the fruit can grow mold or have a grey undertone. However, if you manage your humidity wisely, the incidence is severely reduced. That’s the idea behind the CIC, optimizing growing recipes and eventually expanding the product portfolio because we want to provide a wide selection of product options to our clients.”

Greenhouse application

The knowledge that is generated in the CIC can also be applied to the cultivation of raspberries in greenhouses. Growing these crops indoors allows Certhon to generate ideal growing conditions and maximum potential for raspberry cultivation. With this knowledge, Certhon generates a blueprint that growers can follow in greenhouse cultivation as well.

Andrea explains, “For instance, the blueprint can be followed when growers want to know when to: provide extra lighting, shading, or adjust the humidity. In this way, ideal growing conditions can be mimicked to achieve the highest quality and yield possible in a greenhouse.”

Cane risk

Another, very important aspect is the quality of the raspberry canes. In order to have good production, your raspberry canes need to be of good quality and pest-free. “This cannot always be guaranteed, '' says Andrea, “since they are propagated outdoors and therefore bound to the pressures of external influences, such as climate. Although we have not tried it ourselves yet, we think the next step is to also propagate raspberry canes in a controlled environment without daylight.”

For more information:

Andrea Huegler, R&D Engineer and Agronomist

Certhon

andrea.huegler@certhon.com

ABC Westland 555

P.O. Box 90

2685 ZH Poeldijk

The Netherlands

Tel: +31 174 22 50 80

www.certhon.com

Publication date: Mon 7 Jun 2021

Author: Rebekka Boekhout

© HortiDaily.com

Aspara’s High-Tech At-Home Farm Launches In The U.S.

This official U.S. launch makes the device available to all U.S. consumer

Hong Kong-based Aspara, which makes high-tech, tabletop-sized farming units for homes, is now shipping devices across the U.S. through retailers like Home Depot, Wayfair, and via its own website.

The Spoon flagged Aspara back in January as a company to watch in the up-and-coming at-home farming space because of the device’s small size, lowish price point, and approach to hydroponics. At the time, the company was selling its system, which can fit easily on a countertop, to customers in Hong Kong and in very, very limited quantities via Amazon to other parts of the world.

This official U.S. launch makes the device available to all U.S. consumers. Speaking on the phone today, Rob Alexander, the Owner of Conducted Sales, the sales agent for Aspara in North American markets, said that Aspara has another eight retailers in the works, though he couldn’t at this point use specific names.

High-tech, hydroponic farms have historically been the territory of industrial-scale indoor farming companies — the AeroFarms and Plentys of the world. But following this past January’s CES show, both major appliance makers like LG and Miele along with smaller startups began to heavily publicize a new kind of indoor farm, one created for the at-home consumer. These devices are typically quite small and meant to feed a single household, rather than supply a grocery retailer.

Alexander said Aspara’s homegrown system differs from others on the market in the way it tackles the hydroponic element of farming. It uses what he calls an “ebb and flow” design, where water for the plant roots is constantly replenished from the side unit (see image above), making the water supply easier to refill than many at-home farms. Aspara’s also has sensors that determine nutrient levels in the water, the current level of humidity in the air, and whether a plant is getting too much light. An accompanying app notifies the user when any of these elements need attention.

“It’s trying to give you feedback to create the optimum growing environment,” Alexander said.

Another differentiation: the device is repairable. While that might first sound like a weird selling point (no one wants to buy tech that might break), it actually speaks to how seriously Aspara is pursuing the idea of making its high-tech grow system the kind of kitchen appliance that’s on par with a dishwasher or refrigerator. You don’t throw out a dishwasher the second something goes wrong. In the same way, Aspara users can replace parts like sensors and light canopies, rather than having to go out and buy a whole new farm.

The company’s approach recently won them the Green Product Audience Award.

Price-wise, Aspara is on the lower end of the at-home farming spectrum.

The device goes for $349 right now at Home Depot online.

Of course these days you can’t have a conversation about at-home food production without bringing COVID-19 up. Since Apsara wasn’t available to North Americans at the height of shelter-in-place mandates, the company wasn’t measuring demand for its product in that region. However, Alexander told me they did see a spike in Hong Kong, where the device has been available for some time.

My guess is that with the product available Stateside, that demand will surface quickly. Other at-home farming systems have seen huge jumps in demand recently as the pandemic, panic-buying sprees, and other factors have made many consumers question their total reliance on the traditional food supply chain.

Next up, Aspara wants to do a widespread launch in Canada, and also broaden the types of plants its system can grow to include other types of plants, including fruits and vegetables.

AeroFarms: An Unproven Business With Enormous Risk

AeroFarms's mission is to grow the best plants possible for the betterment of humanity

June 13, 2021

Written by Jamie Louko

Spring Valley Acquisition Corp. (SV) APPHSVSVU

Summary

AeroFarms is a SPAC that is being brought to the market by Spring Valley Acquisition Corp. The deal was announced on March 26.

AeroFarms runs and operates vertical greenhouse farms. Unlike most greenhouses, AeroFarms' greenhouses take up little horizontal space, which allows them to pay less in expenses.

AeroFarms's mission is to grow the best plants possible for the betterment of humanity.

Currently, AeroFarms is not a buy, but it should be on a watchlist for investors to watch closely to see how well they can execute.

sompong_tom/iStock via Getty Images

Investment Thesis

AeroFarms (SV will become NASDAQ: ARFM) is a business that has high hopes, but with little edge from their other tech-savvy competitors, I struggle to see how they will be able to achieve the immense growth they are claiming. With poor financials and only $2.5 million in revenue, this business has not yet shown that it can achieve these expectations. Until AeroFarms can consistently show investors they are able to meet the guidance they set for themselves, it should be avoided by long-term investors.

SPAC Details

AeroFarms is being brought to the market by Spring Valley Acquisition Corp. This was announced on March 26. AeroFarms is expected to receive $317 million in cash from the deal, and the deal is expected to close in the second quarter of 2021, which would assume that AeroFarms would branch off into their Nasdaq listing, ARFM, within the month. However, SPACs usually take 4-6 months from announcement to go public, which would pin AeroFarms around July-September. September is on the longer side of this estimate, and considering estimates from Spring Valley and AeroFarms, a September target is likely inaccurate. I would expect that AeroFarms will go public sometime between late June and late July.

This process would estimate AeroFarms' equity value to be roughly $1.2 billion, which is slightly lower than another competitor that recently SPAC'ed in 2021, AppHarvest (NASDAQ: APPH). After the SPAC process, AeroFarms expects to nominate two of Spring Valley's existing directors, Debora Frodl and Patrick Wood, III, to its Board of Directors. Now that we have the basic details of the SPAC out of the way, let us dive into what AeroFarms does and why they are coming to the public markets.

AeroFarms' Mission

AeroFarms is a vertical greenhouse that is trying to change how Americans create sustainable food. This Certified B-Corp uses vertical farming, AI, and biological sciences to improve the way fresh produce is grown and distributed locally and globally. Their product, Dream Greens, "wins on quality, flavor, taste, and texture," and they sell in many major distributors like Whole Foods, ShopRite, Amazon Fresh, and FreshDirect.

AeroFarms was founded in 2004, and it became a B Corp in 2017. AeroFarms is trying to solve issues brought on by the megatrends of population growth, water scarcity, arable land loss, and climate change.

Source: Analyst Day Presentation

Currently, AeroFarms focuses on leafy greens, primarily bok choy, kale, micro broccoli, and arugula. AeroFarms' reason for existing today is to meet the need to solve issues brought on by climate change and other environmental issues. Due to strong droughts and water scarcity, water will be needed more and more if our world continues to use water at the pace we do today. AeroFarms uses 95% less water than traditional farms, which allows them to be less reliant on these problems, as well as open up water that would have been used to go towards other needs. This lack of water has also caused droughts, which can, in turn, lead to food shortages. Because AeroFarms' greenhouses are not as reliant on water, as well as the fact that they are indoors, these droughts are not as impactful to AeroFarms' business.

Source: Analyst Day Presentation

Simply put, AeroFarms sees great problems with our future if we continue to farm the way we do today, and they are trying to preemptively solve these problems.

Both co-founders are still involved, one as the CEO and the other as the CMO. Considering that AeroFarms was founded in 2004, it is clear that the founders are very dedicated to the vision and the mission of AeroFarms, and they will likely stay with the business for the long haul. If they founded this business simply to make a quick buck, the founders likely would have moved on already instead of dedicating 17 years of their lives to this business. This is a very good sign in my book. However, management is still extremely important for a business like this. If management were to cash out within a year of coming public, that would show me that the founders were not as dedicated as I thought, which would lower my conviction in this business to a more bearish conviction.

Being a SPAC, they were allowed to project revenues and estimates out to 2026. Therefore, it should come as no surprise that this company sees massive growth potential. They expect that vertical farming alone will be a $12.7 billion business by 2026, growing at over 22% 5-year CAGR. They also expect global fresh produce to become a $1.8 trillion industry by 2023, and leafy greens alone will contribute $108 billion to that large TAM. Clearly, this sort of farming is going to grow due to increases in demand (as the population increases). I have some skepticism as to whether it will be this large come 2023, but there is no doubt that the industry will be growing.

Quite frankly, it is near-impossible to correctly estimate how big this market will get. If it gets as big as AeroFarms claims it will, then AeroFarms will definitely have room to fight for market share and they will have vast opportunities to grow and become an amazing business. However, a 22% 5-Year CAGR in vertical farming is definitely aggressive. I worry that AeroFarms may be estimating on the extreme side, and that vertical farming will not grow that fast. If this is the case, then AeroFarms' potential will noticeably decrease, and it would make it a much less interesting investment.

Also, I am a firm believer that the world is going to need more greenhouses as it becomes harder to grow outdoors due to climate change and other sub-optimal weather conditions. There have been many recent droughts and other disasters that make it hard to count on reliable crops from outdoor farms, and greenhouses can minimize the impact that Mother Nature is having on our crop yields.

The sustainability of greenhouses is also a major benefit to society. The water usage is drastically lowered in greenhouses like AeroFarms, and so are emissions. These negative impacts are greatly reduced compared to traditional farms, so AeroFarms is not only helping create a sustainable supply of food, but they are also doing in a very environmentally friendly manner.

Their mission and drive to make our world better is the reason that I am writing about this stock today. I believe that AeroFarms and companies like it are trying to solve a major future problem for our world, and I am happy to give them attention for it. As I have mentioned a few times already, they have tons of competition. This competition is fierce, and it definitely has the potential to make AeroFarms fight for this market share.

Competition Concerns

As I have mentioned many times already, AeroFarms has some steep competition in the greenhouse space they are playing in. Although no major competitors are actively engaging in vertical farming (excluding one), they still have plenty of competition in the sustainable farming space.

Probably the company that first comes to mind is AppHarvest. I have written an article that dives deep into AppHarvest, but I will go over it quickly for anyone who is not extremely interested in AppHarvest. AppHarvest is a business that is based out of Kentucky and Appalachia. Unlike AeroFarms, which primarily focuses on growing leafy greens, AppHarvest's current focus is tomatoes. AppHarvest has plans in place to expand into leafy greens in a major way in the next 5 years, however. With their 60-acre farm (and 9 more facilities on the way), AppHarvest is planning to ramp up production in a major way.

AeroFarms is not expected to grow as fast as AppHarvest. Currently, the only things they are building is an R&D farm facility in Abu Dhabi, and another farm in Danville. The Abu Dhabi facility plans on breaking ground this month. They do, however, have a total of 3 farms, their biggest and only cash-generating farm bring their vertical farm headquarters in Newark, New Jersey. On April 29, 2021, AeroFarms announced that they are breaking ground and starting construction of their second farm, located in Danville, Virginia. Their third farm is the new facility in Abu Dhabi.

Clearly, both of these businesses are growing at a very fast rate. and there is no doubt that it will continue. Although they are not directly competing currently, they will likely be competing in the leafy greens area quite soon. In terms of technology, they are using similar kinds of tech, although I believe that AppHarvest has a very slight edge.

Source: Investor Presentation

The main thing that gives AeroFarms an edge over AppHarvest is how they commercialize their product. One of the weaknesses I have with AppHarvest is how they sell their product. Simply, AppHarvest partners with a distributor, Mastronardi, who then is the sole buyer of AppHarvest's product and they distribute it out to larger companies. This results in a customer concentration for them. AeroFarms does not do this, but rather they partner directly with large businesses like Whole Foods. I like AeroFarms' distribution model much more than AppHarvest's.

I would be remiss if I did not briefly mention some of the private competitors. First, Bowery Farms, another vertical farming company that is private, is a major threat to AeroFarms. First, they are roughly double the size of AeroFarms. Second, they are operating in the same rough geographical region that AeroFarms is selling in. Bowery operates in New York, with plans to expand into Pennsylvania.

Source: Bowery Website

Bowery has 2 operating farms compared to just one for AeroFarms, and they are building one more today. These farms are in New Jersey and Maryland, which is quite intrusive on AeroFarms' market. Bowery also is planning on expanding into berries, tomatoes, and carrots, while they currently grow leafy greens. Due to greater size, they have been able to reach better economies of scale than AeroFarms, so their prices are actually lower currently. Bowery also sells in 850 grocery stores. Like AppHarvest and AeroFarms, Bowery is using a similar structure of technology that enables sustainability and limits pesticides in their farming.

Another strong (and private) competitor is Gotham Greens. They operate a very unique business model: instead of building large facilities, Gotham builds its greenhouses on the rooftops of its customers. This enables extreme freshness for its customer and nearby customers.

Source: Gotham Greens Website

Gotham Greens obviously has more greenhouses built and producing crops than any of the businesses mentioned. They have 8 greenhouses, encapsulating the Northeast, as well as the West of the U.S. Currently, they are operating and selling in 40 U.S. states. Freshness is clearly Gotham's edge over AeroFarms, however, their business model can be both a blessing and a curse. Gotham is limited to small greenhouses, whereas large, 60-acre greenhouses like AppHarvest's are much more cost-effective. AeroFarms sits in the middle of these sizes for its facilities.

All of these businesses have their own edge, and it is still unknown which will make the greatest difference. However, farming is by no means a winner-take-all market. There will be many winners in this space, and potentially even all of these competitors could be successful along with AeroFarms. To quickly summarize, each company has benefits that separate them from the pack. AppHarvest has its central location (Kentucky), Bowery has strong economies of scale due to its size, and Gotham has its ability to deliver the freshest products. Now, I am going to take a look at what makes AeroFarms special compared to some of its competitors.

The Edge

Compared to traditional farming, AeroFarms' technology and sustainability is what separates them. Due to the nature of greenhouses, AeroFarms can have tight control on conditions that the plants experience, so AeroFarms can create the most optimal environment for the plants to grow faster, and be of the highest quality. They also excel at full automation of their farm. Everything from seeding to packaging their produce is fully automated.

Source: Investor Presentation

AeroFarms uses data science and a fully-controlled technology platform that enables it to better understand plants and optimize farms while improving quality and reducing costs. Simply, they are analyzing plant biology to optimize the growth of these plants.

Teams of plant scientists develop custom algorithms to precisely define the conditions each plant needs to thrive. This understanding allows AeroFarms to optimize performance, cultivate new varieties, improve quality, lower costs and optimize efficiency.

Source: Investor Presentation

This understanding of the biology of plants is extremely important for AeroFarms. One of the primary benefits they have over traditional farming is that they can create the best-looking and tasting produce. Understanding exactly how plants thrive and do this is crucial. If they were to expand into different products, such as berries or tomatoes, they would have to do this again. This knowledge may take time to learn, and if they are testing environments to see which one produces the best crops, it could take a while. However, once learned, this can be easily replicated in dozens, if not hundreds, of other facilities. Once AeroFarms learns that leafy greens thrive under (and these numbers/metrics are not accurate but for the example) 75-degree heat with high sun exposure and light water levels, they can replicate those conditions in whatever facility they grow leafy greens in. This intellect is somewhat time-consuming to learn, but once it is learned, it gives the company a massive advantage.

Through the integration of these disciplines, AeroFarms achieves up to 390 times greater productivity per square foot annually versus traditional field farming while using up to 95% less water and zero pesticides. Therefore, due to the productivity, clearly the knowledge that they learned from the data and plant biology is paying off.

Source: Investor Presentation

Another thing that most traditional famers do not have is data. AeroFarms can create lasting network effects and benefit greatly from scale if they can efficiently use and act on data they receive from their facilities.

Lastly, AeroFarms has been creating a strong library of IP since its founding. With over 250 invention disclosures and a vast library of data collected over 15 years of operations, AeroFarms is continually improving its systems to understand plants at unprecedented levels and solve agriculture-related supply chain issues. Currently, AeroFarms has 15 granted patents, with 38 more pending approval. They also have 46 designated trade secrets. The vast amount of trade secrets show that they want to keep its operations relatively unknown to its competitors, so they do not elaborate much on what those secrets entail. However, their strong number of patents show that they have actual technology that is working effectively and it is independent to them. No other greenhouse or direct competitor could do the same thing AeroFarms is doing in some of its capacities.

AeroFarms plans on bringing these trade secrets to future facilities, with plans to start construction on three farms, none of which have been announced or actually planned yet, by the start of 2023. AeroFarms also sees strawberries as a major growth avenue. Strawberries are highly cyclical due to growing conditions and they carry lots of pesticides, both of which AeroFarms is trying to solve in the farming universe.