Welcome to iGrow News, Your Source for the World of Indoor Vertical Farming

Expanding Controlled Environment Agriculture Beyond 'The Big 4'

Greenhouses, vertical farms, and hybrid systems (collectively known as controlled environment agriculture or CEA) continue to attract investment at a much greater scale than in previous decades

By PETER TASGAL

March 29, 2021

Greenhouses, vertical farms, and hybrid systems (collectively known as controlled environment agriculture or CEA) continue to attract investment at a much greater scale than in previous decades. In each of the past five years, there have been multiple nine-figure capital raises. Capital has been deployed across farm types:

Large-scale greenhouses (e.g., AppHarvest, Mastronardi Produce),

Regional greenhouses (e.g., Gotham Greens, Bright Farms),

Localized vertical farms (e.g., InFarm – Berlin, Kalera).

Sources of funding have expanded from almost exclusively highly-specialized private equity investors to include public equity, mezzanine debt and even commercial banks. Within these funding sources, the breadth of investors has expanded beyond agriculture-focused investors to more mainstream investors, especially those with an interest in Environmental, Social and Corporate Governance (ESG) investing.

More from The Packer: Deep dive on the economics of greenhouse growing

Despite all of the investment, the vast majority of produce grown in CEA’s across North America consists of tomatoes, cucumbers, peppers, and lettuce, and leafy greens (“The Big 4”). Most of the lettuce and leafy greens are coming from CEA’s in the U.S. In Canada, The Ontario Greenhouse Vegetable Growers include 220 members producing tomatoes, cucumbers, and peppers on over 3,000 acres of greenhouse.

In my opinion, the next leap for the industry will be expanding the breadth of products. Specifically, focusing on products the taste of which is highly important to the consumer. A strawberry, for example, is a more important purchasing decision to the average consumer compared to lettuce. Lettuce is much more likely to be eaten as part of a salad along with a variety of other ingredients. Today, you can buy at mainstream retail locations a greenhouse-grown strawberry likely grown by Mucci Farms in Ontario or Mastronardi’s Green Empire Farms in New York.

Consumer demand will continue to drive product expansion. Meeting that demand will be possible through further investment in the CEA space. Although investment has been growing, it has not met the levels of other industries where many billions of dollars have been invested on an annual basis. Investment levels in CEA are likely to become far greater over the near future as some of the largest investors in the world are focused on investments that meet and exceed ESG standards.

More from The Packer: On tour with AeroFarms

Efficient vertical farms and greenhouses meet and exceed ESG standards. The farms are closed-loop systems where everything that goes into the farm is contained and recycled. Additionally, as the environment is fully controlled, only the precise amounts of inputs are added so as to limit excess waste. Lastly, a controlled environment allows for plants to grow without chemicals and pesticides.

Combining consumers’ desire for more locally-grown produce throughout all seasons of the year with increased investor appetite should drive great growth across the industry for years to come. I believe the biggest leap will be new and exciting products coming from indoor farms. This will all be enhanced with incremental improvements in product taste, farm efficiency, and additional varieties within The Big 4 and other products to come.

Peter Tasgal is a Boston-area food agriculture consultant focused on controlled environment agriculture.

Evaluating Real Estate For Indoor Agriculture

Several factors need to be evaluated before purchasing or leasing a piece of real estate for CEA. Will you build new construction or rehabilitate a vacant building? Are you building a large-scale greenhouse or a small, urban vertical farm?

March 17, 2021

Traditionally, buyers of agricultural real estate have focused on rural land where primary considerations for their farm include things such as soil quality, annual rainfall amounts, and adequate drainage. Increasingly, however, agriculture start-ups are moving indoors. Compared to field-based agriculture, indoor farming allows for more crop cycles, less water usage, and the farms can be located closer to the consumer. The considerations for an indoor, or controlled environment agriculture (CEA) operation are considerably different than for outdoor farms.

Assessing Potential Real Estate for CEA

Several factors need to be evaluated before purchasing or leasing a piece of real estate for CEA. Will you build new construction or rehabilitate a vacant building? Are you building a large-scale greenhouse or a small, urban vertical farm?

Environment

Weather and terrain are important for natural light greenhouse projects. The primary limiting factor to crop production in a greenhouse is low light intensity during the winter so consult with an Ag-extension service or other resource to get that information for a proposed location. Adequate acreage is a must for not only the greenhouses themselves but, also shipping and receiving space, a retention pond (if needed), and potentially even worker housing.

Spacing

For a vertical or urban farm in an enclosed building, important factors to consider include adequate square footage to allow for proper spacing between growing systems and enough room to move the towers (if mobile) for cleaning or maintenance. Additionally, a building should have a sufficient water supply and potentially drainage, a robust HVAC system and humidity controls, and a ceiling which is high enough for the growing towers. Although indoor farms using high efficiency LED lighting, these systems, combined with pumps, humidifiers, and HVACs can use significant amounts of electricity, a developer should carefully and conservatively estimate those costs prior to negotiating those terms with a landlord or electric company. Finally, the farm should be in close enough proximity to allow for routine delivery to local customers, be they restaurants, groceries, farmers markets, or Community Supported Agriculture distributors.

Labor

In both types of farms, labor availability and cost is a critically important consideration. The cost of wages for urban farms, even for unskilled workers, will likely be higher than that of rural areas. And in the case of any real estate development, ensure prior coordination with relevant agencies has been done on permits, licenses, and zoning regulations prior to signing any leases or closing on a land contract. Prior to starting a search for a CEA project, it’s wise to seek expert help from outside consultants who can save an indoor farm developer time, money, and aggravation.

Tags real estate, indoor agriculture, cea

Eastern Kentucky Company Growing Local Economy By Growing Vegetables Year-Round

AppHarvest has created 300 jobs in Appalachia, an area not really known for growing tomatoes.

by GIL MCCLANAHAN

MOREHEAD, Ky. (WCHS) — Imagine growing fresh local tomatoes in the dead of winter. A company in Eastern Kentucky is using high-tech agriculture to grow vegetables indoors.

To View The Video, Please Click Here.

AppHarvest checks tomatoes growing inside the company's 60-acre indoor greenhouse.

(AppHarvest ) Courtesy Photo

AppHarvest opened in Rowan County, Ky. last October. They are growing more than just vegetables. They are growing the economy in an area that sorely needs it.

What's growing inside AppHarvest's 2.8-million square foot facility is capable of producing more food with less resources.

"For our first harvest to be on a day where there was a snowy mountainside could not have been any more timely. The fact that we are able to grow a great juicy flavorful tomato in the middle of January and February is what we have been working to accomplish," AppHarvest Founder and CEO Jonathan Webb said.

Webb said five months after opening its Morehead indoor farm facility, the company shipped more than a million beefsteak tomatoes to several major supermarket chains, including Kroger, Walmart and Publix. Those large bushels and bushels of tomatoes are grown using using the latest technology, no pesticides and with recycled water in a controlled environment using 90% less water than water used in open-field agriculture.

"We're just trying to get that plant a consistent environment year round with the right amount of light and the right amount of humidity and the right temperature just to grow, and the vines of our crops the tomato plant end up being 45 feet and we grow them vertically so that is how we can get so much more production," Webb said.

One of the company's more well-known investors is Martha Stewart.

"I said Martha, can I get five minutes and I told her what we are doing. She was like, look we need good healthy fruits and vegetables available at an affordable price. I love the region you are working in," Webb said.

A couple of weeks later, Webb met with Stewart at her New York office, and she decided to become an investor in the company. Some local restaurants are looking forward to the day when they can buy their vegetables locally from AppHarvest. Tim Kochendoerfer, Operating Partner with Reno's Roadhouse in Morehead, buys his vegetables from a company in Louisville.

"It will be another selling point to show that we are a local restaurant," Kochendoerfer said.

Webb points out AppHarvest is not trying to replace traditional family farming. "Absolutely not. We want to work hard with local farmers," he said.

Webb said by partnering with local farmers, more local produce can get on grocery store shelves, because last year 4 billion pounds of tomatoes were imported from Mexico.

"What we are working to replace is the imports from Mexico where you got children working for $5 a day using illegal chemical pesticides in the produce is sitting on a truck for 2-3000 miles," Webb said.

AppHarvest has already started influencing the next generation of farmers by donating high tech container farms to local schools. Students learn to grow crops, not in the traditional way, but inside recycled shipping containers. The containers can produce what is typically grown on 4 acres of land. Rowan County Senior High School was the second school to receive one. It arrived last fall.

"We sell that lettuce to our food service department and it's served in all of our cafeterias in the district," said Brandy Carver, Principal at Rowan County Senior High School.

"When we talk about food insecurity and young people going home hungry, what better way can we solve these problems by putting technology in the classroom. let kids learn, then let the kids take the food home with them and get healthy food in the cafeterias," Webb said.

AppHarvest has created 300 jobs in Appalachia, an area not really known for growing tomatoes. Local leaders believe the company will attract more business to the area.

"I fully expect in time we'll see more and more activity along that line like we do in all sectors," said Jason Slone, Executive Director of the Morehead-Rowan County Chamber of Commerce.

"We will eventually be at the top 25 grocers. Name a grocer. We've been getting phone calls from all of them," Webb said.

AppHarvest has two more indoor farming facilities under construction in Madison County, Ky., with a goal of building 10 more facilities like the one in Rowan County by the year 2025.

To find out more about AppHarvest click here.

Fresh Impact Farms Awarded Arlington's First Agriculture Grant

Arlington County received its first-ever agriculture fund grant from the state, money that will go to county-based Fresh Impact Farms.

Operating since 2018, Fresh Impact Farms uses hydroponic technology to grow a variety of speciality herbs, leafy greens, and edible flowers indoors. (Mark Hand/Patch)

ARLINGTON, VA — Arlington County received its first-ever agriculture fund grant from the state, money that will go to Fresh Impact Farms, an Arlington-based company that plans to double production at its indoor growing facility.

Virginia Gov. Ralph Northam announced Monday that he had awarded an Agriculture and Forestry Industries Development, or AFID, Fund grant to Arlington totalling $15,000 to be given to Fresh Impact Farms. The company will receive a total of $30,000 from the government, with Arlington County matching the state grant with local funds.

"Agriculture continues to be a key driver of our economic recovery in both rural and urban areas of our commonwealth," Northam said Monday in a statement. "Innovative, dynamic businesses like Fresh Impact Farms are demonstrating how exciting new opportunities can grow out of pandemic-related challenges."

"I congratulate the company on their success and am thrilled to award the first-ever AFID grant to Arlington County to support this expansion," the governor said.

In recent decades, Arlington County has grown into one of the most densely populated counties in the nation. Up until World War II, Arlington still had plenty of farmland. But over the past 60-plus years, the only farming in the county has been of the backyard and patio variety or in the community gardens in the Four Mile Run area.

Operating since 2018, Fresh Impact Farms uses proprietary hydroponic technology to grow a variety of specialty herbs, leafy greens, and edible flowers indoors.

"Governor Northam's award to Fresh Impact Farms, Arlington's only commercial farm, is an innovative way to celebrate unique uses of technology to help a small business pivot during the pandemic," Arlington County Board of Supervisors Chairman Matt de Ferranti said. "I am thrilled that Fresh Impact Farms is growing and looking to the future of a sustainable food supply."

The company will invest a total of $137,500 as part of the expansion, which will include a second grow room, a larger production facility, and an educational hub where customers, after the pandemic, will be able to see how their food is harvested.

Fresh Impact Farms' community-supported agriculture or CSA, program focuses on leafy greens and home kitchen-friendly herbs and has grown them steadily since the program's creation last April. Along with residential customers, the company now has smaller wholesale clients in the Washington, D.C., area.

The future is bright for urban agriculture, said Ryan Pierce, founder of Fresh Impact Farms, located in the back of a Lee Highway strip mall. (Mark Hand/Patch)

After the start of the pandemic, Fresh Impact Farms decided to shift its business model to a CSA delivery service in order to continue generating revenue.

"Seizing the opportunity created by more people cooking at home, the company initiated a Community Supported Agriculture program targeting area residents," the governor's office said.

"Now, with vaccinations underway and the restaurant industry poised to rebound, Fresh Impact Farms is expanding, which will allow the company to resume supplying their restaurant customers, while also meeting new demand through their CSA program," the governor's office said.

Over the next three years, the company expects to grow an additional 10,500 pounds of Virginia-grown leafy greens, herbs, and edible flowers for restaurant and CSA customers.

The future is bright for urban agriculture, said Ryan Pierce, founder of Fresh Impact Farms, located in the back of a Lee Highway strip mall.

"The support and generosity from the Commonwealth and Arlington County will be valuable as we expand our production and move towards a hybrid model of serving both the needs of restaurants and consumers," Pierce said in a statement. "As the owner of a local food business, nothing gets me more excited than seeing the community come together in support of local food."

The funds from the Arlington County Industrial Development Authority, together with the state grant, represent "an important investment in urban agriculture, sustainability, and technology," Arlington County IDA Chair Edwin Fountain said in a statement. "This project will advance the County's innovative and forward-thinking approach to developing new sectors of economic activity in Arlington."

New York’s Gotham Greens Plans Solano County Indoor Produce Farm

It will be located on 33.6 acres of agricultural land purchased from the university adjacent to Interstate 80.

GARY QUACKENBUSH

FOR THE NORTH BAY BUSINESS JOURNAL

Example of the greenhouse operated by Gotham Greens which announced plans to open in Solano County (Photo courtesy of Gotham Greens)

Gotham Greens Holdings LLC, a firm with indoor agriculture operations across the U.S., Tuesday, announced plans to build a facility next to the University of California, Davis.

The first phase of this 10-acre Solano County facility is expected to open later this year. It will be located on 33.6 acres of agricultural land purchased from the university adjacent to Interstate 80.

The company stated its plans will provide it with the ability to deliver fresh leafy greens, herbs, plant-based dressings, dips and cooking sauces to more retailers, foodservice operators and consumers on the West Coast.

“… We are partnering with one of the highest-ranked agricultural research centers in the world to advance the entire agriculture system,” said Viraj Puri, co-founder and CEO of Gotham Greens. “California is responsible for growing one-third of the country’s vegetables and two-thirds of the nation’s fruit, yet in recent years, issues surrounding drought, food safety and worker welfare have demonstrated the need for continued innovation.”

The greenhouse will generate 60 full-time jobs and provide UC students with the opportunity to learn first-hand how to sustainably grow produce year-round in a safe, clean, climate-controlled environment. The company stated its facilities use 95% less water and 97% less land than conventional farming. Nationwide, Gotham Greens has 500,000 square feet of greenhouse space at five locations staffed by 400 employees.

The UC Division of Agriculture and National Resources and the UC Davis College of Agriculture and Environmental Sciences has entered into a partnership with Gotham Greens to advance research and innovation in the areas of indoor agriculture, greenhouse technology, and urban agriculture to help advance the science, workforce technology, and profitability of indoor agriculture globally.

“We are building a Controlled Environment Agriculture Consortium to support and advance the indoor farming industry, grow more fresh produce on less land and create new jobs for Californians,” said Gabriel Youtsey, the division’s chief innovation officer. “Gotham Greens is an anchoring partner of this research and industry collaboration that we hope will spur innovation, create a new indoor farming workforce and support industry growth.”

Helene Dillard, dean of the college, said, “This partnership will offer our students the chance to learn best practices from leading experts in indoor farming.”

Gotham Greens recently raised $87 million in new equity and debt capital bringing the company’s total financing to $130 million to fuel the next phase of growth.

Founded in 2009 in Brooklyn, New York, Gotham Greens (gothamgreens.com) owns and operates greenhouses in New York, Illinois, Rhode Island, Maryland and Colorado. Its produce is available in more than 40 states and 2,000 retail stores, including Albertsons Companies (Safeway, Jewel-Osco, and Shaw’s), Whole Foods Market, Target, King Soopers, Harris Teeter, and Sprouts.

The company’s products can also be purchased through e-commerce sites including AmazonFresh, FreshDirect and Peapod.

Lead Photo: Gotham Greens

Towards Greater Profitability And Scale In CEA And Vertical Farming

The virtual Indoor AgTech Innovation Summit on June 24-25 will gather the world’s leading farm operators, retailers, food companies, investors, seed companies, and technology providers to meet, network, and cultivate new commercial partnerships

The virtual Indoor AgTech Innovation Summit on June 24-25 will gather the world’s leading farm operators, retailers, food companies, investors, seed companies, and technology providers to meet, network, and cultivate new commercial partnerships.

350+ attendees from the US, Europe, the Middle East, and Asia will participate in live-stream sessions, join roundtable discussion groups and connect directly through 1-1 video meetings and group chats.

By sharing best practices from around the globe, and facilitating new connections and collaborations, the summit offers an invaluable platform to develop new business and accelerate projects across the Indoor AgTech ecosystem.

2021 Key Themes

· Hands-Free Cultivation: Latest developments in robotics, automation and AI

· New Crops: Mapping a pathway to mass production

· Retail Insights: Understanding the drivers behind consumer demand

· Seed Optimization: Breeding a competitive advantage

· Financial Models: The investment models scaling the industry

· Advanced Growing Environments: Blurring lines between lighting and genetics

· Profitability at Scale: The technology driving down OPEX

· Food Systems: Bringing food into urban planning

· Direct to Consumer Business Models: Scaling beyond a city

· Energy Efficiency: Driving down the costs of optimum operations

All participants can schedule video 1-1 meetings with potential partners and clients throughout the summit, and for an extended period before and after the sessions.

By sharing best practices from around the globe, and facilitating new connections and collaborations, the summit offers an invaluable platform to develop new business and accelerate projects across the Indoor AgTech ecosystem.

Summit website: https://indooragtechnyc.com/

Registration:

One Summit Pass: Indoor AgTech Innovation Summit (June 24-25, 2021)

Super Early Bird Price: $195

Register before April 2

Early Bird Price: $295

Register before May 7

Standard Price: $395

Two Summit Pass: Indoor AgTech (June 24-25, 2021) and Future Food-Tech Alternative Proteins (June 22-23, 2021)

Super Early Bird Price: $445

Register before April 2

Early Bird Price: $595

Register before May 7

Standard Price: $695

https://indooragtechnyc.com/register/

Vertical Farms Nailed Tiny Salads. Now They Need To Feed The World

Vertical farming is finally growing up. But can it move from salad garnishes for the wealthy to sustainable produce for the masses?

Gartenfeld Island, in Berlin’s western suburb of Spandau, was once the bellows of Germany’s industrial revolution. It hosted Europe’s first high-rise factory and, until World War II, helped make Berlin, behind London and New York, the third-largest city on Earth.

Today’s Berlin is still a shell of its former self (there are over a hundred cities more populous), and the browbeaten brick buildings that now occupy Gartenfeld Island offer little in the way of grandeur. Flapping in the gloom of a grey November morning in 2020 is a sign which reads, in German, “The Last Days of Humanity”.

Yet inside one of these buildings is a company perched at agriculture’s avant-garde, part of the startup scene dragging Berlin back to its pioneering roots. In under eight years, Infarm has become a leader in vertical farming, an industry proponents say could help feed the world and address some of the environmental issues associated with traditional agriculture. Its staff wear not the plaid or twill of the field but the black, baggy uniform of the city’s hipsters.

Infarm has shipped over a thousand of its “farms” to shops and chefs across Europe (and a few in the US). These units, which look like jumbo vending machines, grow fresh greens and herbs in rows of trays fed by nutrient-rich water and lit by banks of tiny LEDs, each of which is more than ten times brighter than the regular bulb you’d find in your dining room. Shoppers pick the plants straight from the shelf where they’re growing.

Infarm crop science director, Pavlos Kalaitzoglou, in his Berlin lab

Credit Ériver Hijano

Gartenfeld Island, however, is home to something more spectacular. Here, in a former Siemens washing machine factory, stand four white, 18-metre-high “grow chambers”, controlled by software and served by robots. These are the company’s next generation of vertical farms: fully-automated, modular high-rises it hopes will scale the business to the next level. According to Infarm, each one of these new units uses 95 per cent less water, 99 per cent less space and 75 per cent less fertilizer than conventional land-based farming. This means higher yields, fresher produce and a smaller carbon footprint.

Agriculture is a £6 trillion global industry that has altered the face and lungs of the Earth for 12,000 years. But, unless we change our food systems, we’ll be in trouble. By 2050, the global population will be 9.7 billion, two billion more than today. Fifty-six per cent of us live in cities; by 2050 it will be 70 per cent. If the prosperity of megastates like India and China continues to soar, and our diets remain the same, we will need to double food production without razing the Amazon to do it. That sign on Gartenfeld Island might not be so alarmist.

Vertical farmers believe they are a part of the solution. Connected, precision systems have grown crops at hundreds of times the efficiency of soil-based agriculture. Located in or close to urban centres, they slash the farm-to-table time and eliminate logistics. New tech is allowing growers to tamper with light spectra and manipulate plant biology. Critics, however, question the role of vertical farms in our food future. They are towering lunchboxes for late capitalism, they argue – producing garnishes for the rich when it is the plates of the poor we must fill. Vertical farms already make money, and heavyweights including Amazon and SoftBank are investing in various companies in the hopes of cornering a market expected to be worth almost £10 billion in the next five to ten years. Infarm is leading that race in Europe. It has partnered with European retailers including Aldi, Carrefour and Marks & Spencer. In 2019 it penned a deal with Kroger, America’s largest supermarket chain. Venture capitalists have handed the firm a total of £228 million.

Not bad for a hare-brained experiment that started in a Berlin apartment.

An Infarm employee tends to a batch of seedlings in a special incubator

Credit Ériver Hijano

In 2011, a year before he moved to Berlin, Erez Galonska went off-grid. He grew up in a village in his native Israel, but the young nation was growing too, and farms made way for buildings. Soon the village was a town, and its inhabitants ever more disconnected from their natural surroundings.

Galonska’s father had studied agriculture, and the son had dreamed of recovering a connection with nature he felt he had lost. The search took him to the mountains of the Canary Islands, where he found a plot of land and got to work. He drank water from springs, drew energy from solar panels, and spent long hours farming produce he then sold or bartered at local markets.

When he met his now-wife Osnat Michaeli, “I traded it for love,” he says. “Love is stronger than anything.” In 2012, the couple, alongside Galonska’s brother Guy, who had studied Chinese medicine, moved to Berlin to work on a friend’s social media project. But the hunger for self-sufficiency remained. It was “a personal quest,” Michaeli says. “How we can be self-sufficient, live off the grid. Food is a big part of that journey.”

We meet at a Jewish restaurant in Berlin’s historic Gropius Bau art museum. It is mid-morning, and Covid-19 has cleared the tables. But a row of Infarm units whirs away quietly along one wall, producing basil, mint, wasabi rocket (a type of rocket leaf with the punchy flavour of wasabi), and other, more exotic herbs. Such produce was a pipedream for the three Infarm co-founders eight years ago. Growing crops when living on a tropical island was one thing. Doing it in a small apartment, located in the tumbledown Berlin neighbourhood of Neukölln, was quite another. Soon after moving from the Canaries, Erez Galonska typed “can you grow without soil” into Google.

Japan had taken to indoor farming in the 1970s, and this bore some helpful information on its techniques. The same was true of illegal cannabis growers, who swapped tips about hydroponics – growing with nutrient-packed water rather than soil – across subreddits.

Several trips to a DIY store later, the trio had what resembled a hydroponic farm. It was a big, chaotic Rube Goldberg machine, and it leaked everywhere. Growing wasn’t simply a case of switching on the lights and waiting. Brightness, nutrients, humidity, temperature – every tweaked metric resulted in an entirely different plant. One experiment yielded lettuce so fibrous it was like eating plastic. “We failed thousands of times,” Erez Galonska says.

Two of Infarm’s co-founders, Osnat Michaeli and Erez Galonska

Credit Ériver Hijano

Eventually, the team grew some tasty greens. They imagined future restaurant menus boasting of food grown “in-farm”, rather than simply made in-house, and founded Infarm in 2013. But there was a hitch: indoor-grown cannabis sells for around £1,000 per kilo. Lettuce for £1.20. Most of the early vertical farms required heaps of manual work and operated in the red. “It simply wasn’t a sustainable business model,” Erez Galonska says.

By 2014, they decided to roadshow their idea and shipped a 1955 Airstream trailer – a brushed-aluminium American icon – to Berlin. The trailer belonged to a former FBI agent, but it was conspicuous in a city of Volkswagens, caravans and Plattenbau buildings. Michaeli and the Galonska brothers transformed it into a mobile vertical farm, then pitched up at an urban garden collective in Berlin’s trendy Kreuzberg district. There they proselytised indoor farming to urban planners, food activists, architects and hackers, handing out salads and running workshops. Fresh, local food – even if it cost a little more – would entice a growing number of foodies who were interested in where their meals came from. The trailer cost nothing but petrol money to move, and emissions from the growing process itself were almost nil.

When the designer of a swanky hotel across town came by trailer, he asked if the team could install something similar in his restaurant. “That was really the trigger,” says Guy Galonska. “We rented a workshop and we got to develop a system for them.”

When they installed their first “farm” in a Berlin supermarket, VCs took notice and visited Infarm’s young founders at their Kreuzberg office-cum-kitchen, where they hosted dinner parties featuring Infarm crops. But a return on investment still seemed distant: some investors thought the farms were an art project. Maintaining locations manually was exhausting, and the team almost went bankrupt “two or three times,” Guy Galonska says. “I think all of us got a lot of white hair during that time,” he adds. “It was a very challenging thing to do.”

A €2 million grant from the European Union in 2016 helped. With it came deals to place Infarm units in supermarkets and restaurants across Germany. Managing them all would require something precise, connected and efficient. To become a sustainable business, Infarm would have to behave less like a farm, and more like a tech startup.

An Infarm kiosk in the Edeka Supermarket E Center in Berlin

Credit Ériver Hijano

For around 2,500 years after King Nebuchadnezzar II of Babylon gifted his wife some hanging gardens, little changed in the world of hydroponic farming. Asian farmers grew rice on giant, terraced paddies, and Aztecs built “chinampa” rigs that floated along the swamps of southern Mexico.

Life magazine published a drawing of stacked homes, each growing its own produce, in 1909, and the term “vertical farming” appeared six years later. The US Air Force fed hydroponically-grown veggies to its troops during World War II, and Nasa explored the tech as a solution for life off-planet. But vertical farming didn’t really capture public imagination until 1999, when Dickson Despommier, a Columbia University professor, devised a 30-storey skyscraper filled with farms. In 2010, Despommier published The Vertical Farm: Feeding the World in the 21st Century, which has become the industry’s utopian testament.

“I had no expectations whatsoever that this would turn commercial,” Despommier says. “We just thought it was a good idea, because we didn’t see any other way out of stopping deforestation in favour of farming, and keeping the carbon dioxide content of the atmosphere at a reasonable level. It turned out to be a crazy idea whose time has come.”

The vertical farming concept is simple: growing produce on vertically-stacked levels, rather than side by side in a field. Instead of the Sun, the vertical farm uses artificial light, and where there is ordinarily soil, growers use nutritious water or, in the case of “aeroponic” farms, an evenly-dispersed mist.

Vertical farms take up a vanishing amount of land compared to their conventional cousins. They use almost no water, don’t flush contaminating pesticides into the ecosystem, and can be built where people actually live. But, by and large, they have not functioned as businesses. Only the black-market margins of weed, and Japan’s high-income, high-import food ecosystem, have catered to profit. It costs hundreds of thousands of pounds to erect a mid-sized vertical farm, and energy use is prohibitively high.

Advances in technology are changing this. By bolting automation, machine learning and cloud-connected software on to vertical farms, firms can trim physical labour, increase capacity and maintain a dizzying range of cultivation variables. Infarm staff at a separate office to the new Berlin farm, located some 23km southeast of Spandau in the Tempelhof district, keep track of “plant recipe” settings at any one of the startup’s 1,220 in-store units, including CO2 levels, pH and growth cycles, via the company’s Farm Control Cloud Platform, a bit like a giant CCTV room. Machine learning finesses recipes, and keeps each plant as uniform as possible.

Inside the new vertical farm, trays of produce are tended by automated systems

Credit Ériver Hijano

Gartenfeld Island’s employees – mechanical and electrical engineers, software developers, crop scientists and biologists – get closer to the produce, but only just. They monitor via an iPad and feed crops into the building’s four massive grow chambers, or farms, each one about the height and width of two London buses, with ventilation systems that whoosh like a subdued turbine hall.

From there on in, robots do the hard work. Inside the farms, a robotic “plant retrieval system” – basically a tricked-out teddy picker – scoots up and down a perpendicular beam, plucking trays of plants in various stages of growth and shuffling them closer, or further, from LED lights at the summit. The firm claims this reduces service time by 88 per cent. A sliver of the window is the only way to see the device in-person: everything is hermetically sealed to keep out pests. “With automation, you invest once and then that price goes down over time,” says Orie Sofer, Infarm’s hardware lab lead. “With human labour, unfortunately, over time the price goes up.”

The number of crop plants varies depending on the produce, but there are usually just under 300 in a “farm” at any one time. Each farm yields the equivalent of 10,000 square metres of land and uses just five litres of water per kilo of food (traditional vegetable farming uses around 322 litres per kg).

Infarm is not alone in this revolution. AeroFarms, a Newark, New Jersey-based startup, feeds an aeroponic mist to roots that are separated from their leaves by a cloth. It’s most recent funding round was led by Ingka Group, the parent of Swedish furniture giant IKEA. New York’s Bowery Farming, like Infarm, focuses on automation and a proprietary dashboard called BoweryOS that, among other things, takes photos of crops in real-time for analysis. It’s £123 million in backing comes from investors including Singapore’s sovereign fund Temasek. Bowery CEO and founder Irving Fain believe his addressable market “is about a hundred billion dollars a year, just in the US, of crops that we think are good candidates for us to grow.”

Leading the vertical farming VC race is Plenty, a San Francisco-headquartered brand that has raised almost half a billion pounds in the capital since it was founded in 2013, including a 2020 Series D round led by Masayoshi Son’s $100 billion SoftBank Vision Fund. Plenty feeds its greens with water that trickles down six-metre-tall poles; infrared sensors pour data into an algorithm that nudges the plant’s growth recipe accordingly.

Plenty co-founder and chief science officer Nate Storey, who works at the company’s test farm in Wyoming, likens these deep-tech solutions to the tools that powered agriculture’s most recent revolution: “The tractor allowed farmers to be freed from constraints. Half of their land was dedicated to raising draft animals, and the tractor came along and freed them from a life where they were basically managing animals just so they could plough their land.”

For them, he says, automation is similar. “It allows us to get rid of the hardest work – the work that is unpleasant, the work [growers] don’t like to do – and focus on the work that really matters.”

Infarm kiosks inside the Beba restaurant in the Gropius Bau museum

Credit Ériver Hijano

Infarm differs from the competition on two fronts. The first is its focus on modular design: each component is compatible and scalable, like a giant, noisy LEGO set. Modularity makes it possible to install Infarm units anywhere in the world in a matter of weeks, no matter the size. That enables the company’s second USP: its business model. Infarm has no stores, selling produce instead via its remote units.

Clients tell Infarm which produce they want, and “create a schedule,” says Michaeli. “You buy the plants. Everything on the farm is controlled by Tempelhof. Everything that’s grown belongs to the client.” A chef may demand pesto that’s made from particular three-day-aged Greek and Italian basil, for example. Infarm can do that (Tim Raue, Berlin’s most famous chef, is a customer). “Everyone stops and asks about the farm,” one Berlin store manager says. “It’s great to have innovation here.”

Infarm has “two big advantages,” says Nicola Kerslake, founder of Contain Inc, a Nevada-based agtech financier. “One is that they’ve figured out how to do product onsite, which is really not very easy. And the other is that they have these great relationships with big purchasers like Marks & Spencer.”

“When you look at where the arms race is in this industry,” she continues, “it’s really been in two areas: How do I get hold of as much capital as possible, and how do I sign up the right partners? Having Marks & Spencer in your back pocket is really useful.”

It has helped encourage investors to open their chequebooks. Hiro Tamura, a partner at London VC firm Atomico, first met Infarm’s founding trio in 2018. A year later he led its £75 million Series B round. “They could roll these things out,” he says. “They worked, and they didn’t need some industrial-sized warehouse to do it. I didn’t lean in, I fell into the rabbit hole. And it was incredible. I was like, wow, these guys are thinking about time and speed to market modularity.”

Infarm ploughs a chunk of its revenue back into research. In a mezzanine-level lab sitting above the farms at Gartenfeld Island, a dozen white-coated analysts conduct tests on herbs to a soundtrack of Ariana Grande, measuring crop sugar levels, acidity, vitamins, toxicity, antioxidants and more. Via a process of phenotyping – the study of organisms’ characteristics relative to their environment – they hope to create more flavourful plants, or new tastes altogether.

“It’s not just about the hardware,” Kerslake explains. “It’s about how the hardware interacts with the rest of your farm system. And we’re starting to see a lot more sophistication on that front because the AI programs these companies started three or four years ago are now starting to bear fruit.”

Infarm’s results are high-quality: juicy lettuce, wasabi rocket that kicks, and basil that’s far more fragrant than the budget variety. “The end goal with almost everything that we’re doing is developing some sort of playbook, some sort of modular and standardised system, that we can then copy-paste to wherever we go,” says Pavlos Kalaitzoglou, Infarm’s director of plant science. Across from the lab, tomatoes and shiitake mushrooms grow in wine cellar-size chambers. They are living proof of how the firm is looking to diversify from herbs and leafy greens, whose low energy and water requirements make them the staple crop of every vertical farming startup today.

Rows of LED-illuminated produce inside one of Infarm’s four massive new grow chambers

Credit Ériver Hijano

We are in danger of farming the planet to death. Agriculture already occupies 40 per cent of all liveable land on Earth, and food production causes a quarter of all greenhouse gases. An area the size of Scotland disappears from tropical rainforests, responsible for up to a quarter of land photosynthesis, each year. Clearing more trees to feed our spiralling population will not help.

“We need to go back to the drawing board and rethink which avenues we can environmentally afford to pursue,” says Nicola Cannon, a professor at the Royal Agricultural University in Cirencester. Nitrogen fertiliser is particularly harmful to the environment, Cannon adds, “and has led us to adopt systems which have grossly exceeded the planetary boundaries.”

Current food systems are wildly inefficient: waste accounts for 25 per cent of all calories. And yet, almost a billion people suffer from hunger worldwide. These are not issues vertical farming will solve, critics, argue. Going local does little beyond satisfying consumers.

Energy is another tricky issue. Ninety per cent of Infarm’s electricity today is renewable, and it wants to reach zero emissions in the next few years. But this doesn’t factor in the environmental cost of building a steel-and-cement facility.

“Vertical farms are a round-off error to the round-off error in terms of contributing to the big levers out there,” Jonathan Foley, an environmental scientist based in Minneapolis, says. “Like most technologies that are getting a lot of venture capital and which come from Silicon Valley kind of thinking, it’s being massively overhyped at the cost of real solutions. There’s an opportunity cost to put all this technology, money and renewable energy – that could be used for other things that we need energy for – into growing arugula for rich people at $10 an ounce.”

More than half the world’s food energy comes from its three “mega-crops”: wheat, corn and rice. They require wind, seasons and micronutrients that vertical farms are unable to replicate today. These are the crops that can prevent famine in Somalia, Bangladesh or Bolivia – not lettuce. “Vertical farms are growing the edge of the plate, not the centre of the plate,” Foley says.

But Despommier says it’s too soon to criticise the young industry for not addressing issues such as crop diversity. “What you’re really seeing is a rush towards profitability to get their feet wet, and to get their ledgers in the black and to pay off their investors, before they start diversifying,” he says.

“In a world where you think that land is unlimited and that resources are unlimited, indoor farming would be nonsensical,” Plenty co-founder Storey says. “As crazy as it seems to replace the Sun with electricity, it makes sense today. And it really makes more and more sense as time goes on.”

Much of the hope vested in vertical farms rests on the light-emitting diode. This tiny bead of light is the industry’s packhorse: it is a farm’s biggest financial layout and the nucleus of its most exciting advances. Modern LEDs are nothing like the ones that powered your childhood TV. They’ve progressed at such a rate, in fact, that they’ve developed their own law to adhere to: “Haitz’s Law”. Each decade, their cost drops by a factor of ten, while the light they generate leaps by a factor of 20.

That curve will eventually plateau, experts say. But not before LEDs improve enough to allow vertical farms to profit from food closer to the middle of the plate. Infarm’s current smart LED set-up is over 50 per cent more efficient than the one that lit its first farms. Haitz’s Law has helped some companies experiment in growing potatoes, which require far more energy and water than leafy greens. Turning profit from a crop that delivers the highest calories per acre would be momentous for the industry.

The cutting edge of LED technology today is smart sensors that can regulate the brightness and spectrum of light to replicate growing outdoors – or enhance it. Much of the planet’s first flora grew only in the ocean, which looks blue because it absorbs blue light at least.

Photosynthesis, therefore, occurs best between the blue and red light spectra. By tailoring LEDs to emit only these colours, or by dimming at intervals meant to mirror a plant’s natural cycle, vertical farmers can further reduce their energy burden – like stripping a road car to its bare bones so it can drive faster.

Recent discoveries have been more surprising. Strawberries, for example, react particularly well to green light. Some spectra can increase vitamin C in concentrated fruits like kiwis, while others extend shelf-lives by almost a week. In the future, says Fei Jia, of LED firm Heliospectra, growers “can get feedback from the lighting and the plants themselves on how the lighting should be applied… to further improve the consistency of the crop quality.”

“If you judge it from what you have today, you understand what [critics] are saying,” Guy Galonska says. “How can you grow rice and wheat and save the world? And they are right. But they can’t see ten years ahead: they can’t see all the different trends that are going to support that revolution.”

Other technological advances are helping agriculture in different ways. Drones and sensors help map and streamline growing. Drip irrigation dramatically reduces the burden on dwindling water supplies. Circular production – where waste products from one process contribute to fuelling another – is becoming more commonplace, especially in livestock farming. Cell-grown or insect-based meat (or vegetarianism) will reduce our reliance on livestock, which consume 45 per cent of the planet’s crops. Infarm, and the broader vertical farm cohort, may not be saving the world today. But it wants to build taller farms, place them in public buildings like schools, and teach people the value of fresh, healthy vegetables. If 70 per cent of us are to live in cities, then cities “can become these communities of growing,” says Erez Galonska.

Ultimately, Infarm wants to build a network of tens of thousands of automated farms, each one pumping streams of data back into a giant AI system in Berlin. This “brain”, as Galonska calls it, will pour that information into algorithms to generate better food at lower costs, each new yield shaving fractions from the water, energy and nutrients required. Then, Infarm could become something closer to the dream Galonska left behind in the Canaries: truly self-sufficient.

It’s a long way from the leaky, DIY gadget he and his co-founders built in their front room. “The way the world is going now, it’s very clear to everyone it’s running in the wrong direction,” Galonska says. “We definitely believe in the power of collaboration: bringing those outside-the-box thoughts to create a new system that will generate more food, better food, much more sustainably, and help to heal the planet – because that’s the main issue on the table.”

UPDATE - Vertical Farming Leader Kalera Welcomes Maria Sastre to Board of Directors

Sastre brings world-class customer service and operations experience as Kalera prepares for rapid domestic and international expansion.

A seasoned executive with experience in the food, travel, and tourism industries, Sastre brings with her over 25 years of executive leadership and experience and currently sits on the boards of esteemed, Fortune 500, multibillion dollar public and private companies, including General Mills and O’Reilly Auto Parts.

ORLANDO, Fla., Feb. 24, 2021 (GLOBE NEWSWIRE) -- Kalera (Euronext Growth Oslo ticker KAL, Bloomberg: KSLLF), one of the fastest-growing and largest vertical farming companies in the world and a leader in plant science for producing high-quality produce in controlled environments, today announced the appointment of Maria Sastre to its Board of Directors. A seasoned executive with experience in the food, travel, and tourism industries, Sastre brings with her over 25 years of executive leadership and experience and currently sits on the boards of esteemed, Fortune 500, multibillion dollar public and private companies, including General Mills and O’Reilly Auto Parts. The addition of Sastre to the board coincides with Kalera's rapid expansion into several new markets and its acquisition of Vindara Inc., the first company to develop seeds specifically designed for use in vertical indoor farm environments as well as other controlled environment agriculture (CEA) farming methods.

“We are thrilled that someone of Maria’s caliber has chosen to join Kalera’s board,” said Daniel Malechuk, Kalera CEO. “Her resume is beyond impressive, with extensive experience leading highly successful international and growing companies, and is a strong complement to our industry-leading management team and board of directors. She has proven time and again that she is invaluable in helping scale businesses, and will be an incredible asset to Kalera during this time of rapid growth, both domestically and abroad.”

In addition to her aforementioned business experience, Sastre also served on numerous civic and non-profit boards such as the Greater Miami Visitors and Convention Bureau(Chair), the Executive Advisory Board of Florida International University School of Hospitality,and the Executive Board of the United Way of Miami-Dade County. She has been recognized as one of the Top 80 U.S. Hispanics and Top 20 Latinas and has received numerous awards in the travel and hospitality industry sectors. Sastre's education includes a Bachelor's degree and a Master's in Business Administration, both from New York Institute of Technology.

“As someone with a passion for optimizing customer experiences, I am proud to join Kalera’s board as I fully believe their product is a category leader,” said Maria Sastre, new Kalera board member. “Kalera has the opportunity to serve diverse customer segments and increase accessibility to a product that is inherently safer, cleaner, fresher, more sustainable, and more nutritious and flavorful. In a world where brands are looking for ways to differentiate their products and services to their discerning customers, the Kalera portfolio is well positioned to offer the best vertical farming product solution. I trust my years of experience in operations and customer service will prove beneficial as Kalera expands into new markets.”

Sastre previously served as the President and Chief Operating Officer for Signature Aviation, the largest worldwide network of fixed-based operations and maintenance centers for private aviation. Before joining Signature, she spent eight years at Royal Caribbean Cruises LTD, where she held the positions of Vice President, International, Latin America, Caribbean and Asia; and Vice President of Hotel Operations. Her roles included strategic growth across emerging markets as well as managing all aspects of operations and the guest experience onboard Royal Caribbean's fleet of vessels. Previously, Sastre served as Vice President of Worldwide Customer Satisfaction for United Airlines, where she led the newly created customer-satisfaction division charged with refining the customer-service experience.

Kalera currently operates two growing facilities in Orlando, and is building facilities in Atlanta, Houston, Denver, Columbus, Seattle, and Hawaii. Kalera is the only controlled environment agriculture company with coast-to-coast facilities being constructed, offering grocers, restaurants, theme parks, airports and other businesses nationwide reliable access to locally grown clean, safe, nutritious, price-stable, long-lasting greens.Kalera uses a closed-loop irrigation system which enables its plants to grow while consuming 95% less water compared to field farming.

About Kalera

Kalera is a technology driven vertical farming company with unique growing methods combining optimized nutrients and light recipes, precise environmental controls, and clean room standards to produce safe, highly nutritious, pesticide-free, non-GMO vegetables with consistent high quality and longer shelf life year-round. The company’s high-yield, automated, data-driven hydroponic production facilities have been designed for rapid rollout with industry-leading payback times to grow vegetables faster, cleaner, at a lower cost, and with less environmental impact. To learn more visit www.Kalera.com.

Media Contact

Molly Antos

Phone: (847) 848-2090

Email: molly@dadascope.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/bb487877-0d3b-4e1c-9492-9ea280c217a1

GoodLeaf Farms Launches Aggressive Expansion Plans

GoodLeaf will bring its innovative and proprietary controlled-environment agriculture technology to more Canadian markets over the coming year

NEWS PROVIDED BY

McCain invests in a national network of vertical farms to bring tasty, local food to Canadians

GUELPH, ON, - With the closure of a successful new funding round, GoodLeaf Farms is embarking on an aggressive growth and expansion plan to build a national network of vertical farms that will bring fresh, delicious, nutritious and locally grown leafy greens to Canadians across the country.

Backed by a sizeable investment from McCain Foods Limited — which has increased its total investment in GoodLeaf to more than $65 million — GoodLeaf will bring its innovative and proprietary controlled-environment agriculture technology to more Canadian markets over the coming year, providing more Canadian consumers with year-round local food that is typically imported from the Southern United States or Mexico.

"From our start in Truro to our first commercial farm in Guelph, GoodLeaf has built a strong foundation for future growth," says Barry Murchie, Chief Executive Officer of GoodLeaf. "We want to be a global leader in vertical farming. Our first step to accomplishing that is ensuring we have a strong footprint in Canada, giving Canadians access to top quality, nutrient-dense, sustainably grown and pesticide-free leafy greens 365 days a year."

GoodLeaf opened its first commercial vertical farm in Guelph, Ont., in the fall of 2019. By the end of 2021, GoodLeaf is planning two more indoor vertical farms — one to serve the grocery and foodservice networks in Eastern Canada, and one for Western Canada.

The exact locations will be announced shortly.

"It is our intention to build farms that support the Canadian grocery store network, foodservice industry and consumers," says Mr Murchie. "We want to change what people are eating by providing a fresh, healthy and local alternative that, until now, hasn't been available in Canada. We are driving a new way to grow food, with disruptive technology that brings consumers leafy greens from their own backyard. This is a fundamental game-changer."

GoodLeaf's vertical farm grows to produce on hydroponic trays stacked in multiple horizontal levels. A proprietary system of specialized LED lights is engineered to emulate the spring sun, giving plants the light they crave to maximize photosynthesis. The indoor controlled environment is almost clinical, meaning there are no pesticides, herbicides or fungicides used. It is also immune to weather extremes, such as summer droughts or late spring frosts that can be lethal to crops.

Furthermore, having a local source of year-round food is vital to Canada's food security and sovereignty, concerns that were in the spotlight at the height of the COVID-19 pandemic as shoppers were faced with rapidly dwindling supplies on grocery store shelves.

At its 45,000-square-foot Guelph farm, every day GoodLeaf is harvesting microgreens (Spicy Mustard Medley, Asian Blend, Micro Arugula, Micro Radish and Pea Shoots) and baby greens (Ontario Baby Kale, Ontario Baby Arugula and Ontario Spring Mix) for Ontario grocery stores, ensuring a local supply of fresh, nutrient-dense leafy greens all year long.

GoodLeaf produce is exceptional in a salad, as a topping for burgers and sandwiches, as a kick of nutrients in a smoothie or as an ingredient to elevate your favourite dish.

Follow GoodLeaf Farms on Instagram @goodleaffarms and Like it on Facebook at /GoodLeafFarms.

About GoodLeaf Farms:

With a passion for delicious, nutrient-rich greens, GoodLeaf was founded in Truro, NS, in 2011. Using innovative technology and leveraging multi-level vertical farming, GoodLeaf has created a controlled and efficient indoor farm that can grow fresh produce anywhere in the world, 365 days of the year. The system combines innovations in LED lighting with leading-edge hydroponic techniques to produce sustainable, safe, pesticide-free, nutrient-dense leafy greens. GoodLeaf has ongoing R&D Programs in collaboration with the University of Guelph, Dalhousie University and Acadia University.

Learn more at goodleaffarms.com.

About McCain Foods (Canada)

McCain Foods (Canada) is the Canadian division of McCain Foods Limited, an international leader in the frozen food industry. McCain Foods is the world's largest manufacturer of frozen potato specialities, and also produces other quality products such as appetizers, vegetables and desserts that can be found in restaurants and retail stores in more than 160 countries around the world. In Canada, the company has eight production facilities with approximately 2,400 employees and, in addition to its famous French fries and potato specialities, makes frozen desserts, snacks and appetizers.

SOURCE GoodLeaf Farms

For further information: Michelle Hann, Senior Consultant, Digital and Communications, Enterprise Canada, mhann@enterprisecanada.com, 613-716-2118

2021 GLASE Webinar Series

The production of high nutrient density crops in controlled environments (such as greenhouses and plant factories) allows for high density, local, year-round food production

Urban CEA: Optimizing Plant Quality,

Economic And Environmental Outcomes

Date: February 25, 2021

Time: 2 p.m. - 3 p.m. EDT

Presented by: Dr. Neil Mattson (Cornell University)

Click Here To Register

The production of high nutrient density crops in controlled environments (such as greenhouses and plant factories) allows for high density, local, year-round food production. Mattson leads a National Science Foundation project that seeks to better understand the benefits and constraints of urban CEA including: economics, natural resource use, carbon footprint, and nutrition. Mattson will discuss research that seeks to optimize crop performance, nutrition, and resource use through strategic LED lighting and CO2 supplementation. Finally, Mattson will discuss efforts of the NSF project to define workforce development needs by the nascent urban CEA industry and a new USDA workforce development project to expand training opportunities in CEA for 2-year colleges and lifelong learners.

Special thanks to our Industry partners

Join today

If you have any questions or would like to know more about GLASE,

please contact its executive director

Erico Mattos at em796@cornell.edu

Take A Virtual Tour of The New CEA Center

“What OHCEAC is unique about is that we are integrative, interdisciplinary, and inclusive team conducting collaborative research to respond to CEA stakeholder needs

18-02-2021 | Urban Ag News

US, Ohio- Dr. Chieri Kubota, the Director of the new center focusing on controlled environment agriculture and protected cultivation hosted this event to introduces the programs and membership at The Ohio State University.

“What OHCEAC is unique about is that we are integrative, interdisciplinary, and inclusive team conducting collaborative research to respond to CEA stakeholder needs. Our focus inclusively covers various production systems and crop types. We use the terminology of CEA as having a very broad meaning including soil-bassed or soilless systems under various types of climate control or modification structures.”

Source and Photo Courtesy of Urban Ag News

Signify Adds Automatic Intensity Adjustment Plus Year-Long Recipe Modulations To Horticultural Controls

There’s something for both the greenhouse and the vertical farm in the GrowWise tweaks, which in some cases rely on tying to other systems’ sensors.

The Signify toplights at Belgium’s De Glastuin lettuce greenhouse automatically dim or brighten as daylight levels changes. (Photo credit: All images courtesy of Signify.)

Signify has enhanced the control system for its greenhouse LED lighting so that toplights can react immediately to changes in daylight conditions and adjust brightness accordingly. The company has also added year-long control settings intended to allow vertical farmers — but not greenhouses — to program seasonal variations in LED spectral content over a 365-day period.

Both upgrades are intended to reduce manual labor and improve overall cost efficiencies, Signify said.

Until now, greenhouse farmers could dim or brighten their Signify toplights by instructing the lights to do so via the control system, called GrowWise. Signify has now modified GrowWise software so that it can take readings from daylight sensors that are part of separate systems. GrowWise then instantly and automatically adjusts artificial light intensity emitted by the toplights, called Philips GreenPower LED.

“The lighting can be used much more efficiently since it gives us the flexibility to reduce light levels at any moment we need to,” said Wouter de Bruyn, the owner of Belgian lettuce grower De Glastuin, an early user of the new automatic feature.

Whereas Signify is known in office settings to build sensors into its smart luminaires, the GrowWise controls make use of sensors that are part of climate control systems and greenhouse management systems from companies such as Priva, Hoogendern Growth Management, and Ridder, all based in Holland.

Planet Farms’ Luca Travaglini backs up Signify’s point that prescribing a year of spectral content improves efficiency and helps keep down manual labor costs in controlled environment agriculture (CEA) operations such as vertical farms.

“The climate computer is equipped with a daylight sensor that sends actual light measurements to the GrowWise Control System so we can adapt our light levels automatically to ensure an even light level throughout the day and season,” de Bruyn said at De Glastuin, based in Kontich.

“Dynamic lighting in a greenhouse is the next step in improving the cost efficiency and quality for the cultivation process,” said Udo van Slooten, business leader, horticulture LED solutions at Signify. “It allows growers to effortlessly maintain a consistent level of light throughout the day to produce the best possible crops. The system compensates for cloudy weather and creates a more controlled growing environment for your crop.”

In another upgrade to GrowWise, vertical farmers who want to prescribe modulations in spectral content are no longer limited to 24 hours of looped recipe cycles. Rather, they can order up a year’s worth of shifts for controlled environment agriculture (CEA) operations.

The year-long programming feature is aimed at vertical farmers rather than at greenhouses because the lights that Signify provides for vertical farms support controllable spectral changes, whereas the greenhouse toplights do not. Signify refers to its GreenPower LED vertical farm lights as “production modules” rather than as “toplights.” Toplights and production modules can both be programmed for intensity over a year, but the intention of the year-long feature is oriented toward spectral content.

Compared to greenhouses, vertical farms tend to make much less, if any, use of natural light. In vertical farms, the lights are mounted much closer to the crop in stacked shelves.

One of the first users of the year-round feature is Italy’s greens and lettuce grower Planet Farms.

“Now we can easily create custom light recipes and set them to run year-round to provide the right light recipe with the right light intensity at the right time throughout the crop’s growth cycle,” said Planet Farms co-founder Luca Travaglini. “By automating our full light strategy during the growth cycle, for the whole year, we can run our operations very efficiently and keep our manual labor costs low. That makes it easier for us to maintain consistent quality as we scale up our production.”

The horticultural market is a key growth sector for Signify, especially as it maps out a strategy to maintain profits in the pandemic economy, in which last week it reported a yearly rise amid rigorous cost controls that now include a small number of layoffs. CEO Eric Rondolat is targeting a big chunk of what he has quantified as a $2 billion general horticultural lighting market by 2023.

MARK HALPER is a contributing editor for LEDs Magazine, and an energy, technology, and business journalist (markhalper@aol.com).

Delivering The Optimal Growing Parameters

“Especially in the pharmaceutical or supplemental industry, you need an extremely strict batch control that leaves no room for variation,” says Dr Alexis Moschopoulos, Managing Director at Grobotic Systems.

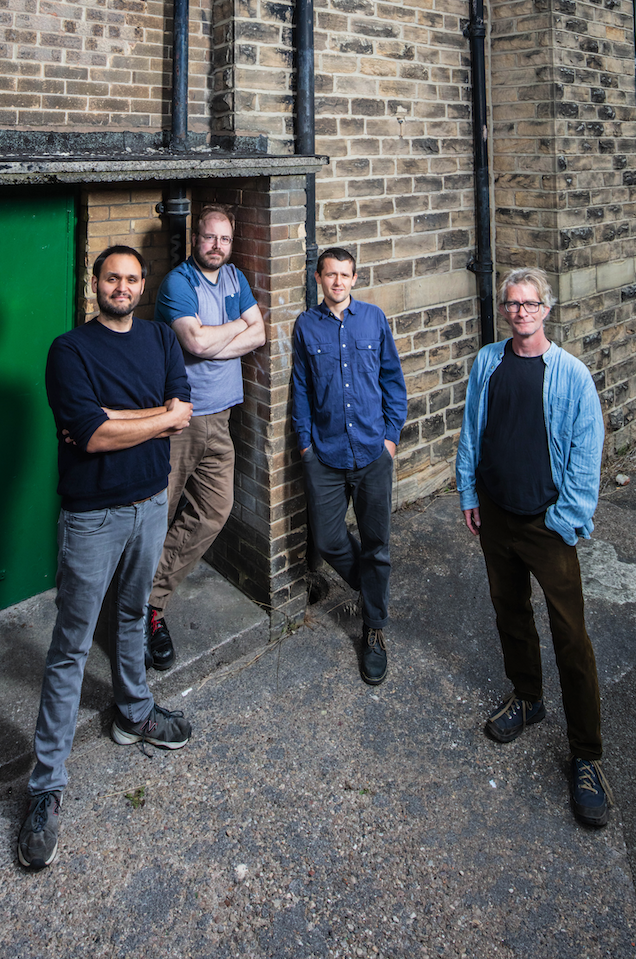

The Grobotic Systems team shows off an early prototype Grobotic chamber. From left to right: Gareth Coleman (Software Developer), Richard Banks (Chief Technology Officer), Dr Alexis Moschopoulos (Managing Director), and Andrew Merson (Mechanical Engineer). Credit: UKRI.

Growing a new variety

Indoor farming has numerous growing parameters to take into account. Particularly when growing a new variety, all variables should be perfected in order to reach an optimum yield. In an indoor space, experimenting with these environmental parameters might, however, seem tricky. But what about trying out this environment in a smaller setting, such as an experimental growth chamber?

Alexis is fully aware of the challenges that vertical farmers face. The environmental control needs to be as precise as possible, as the effect of different light spectra or nutrients may have a significant impact on crop yield and quality. With this challenge in mind, Grobotic Systems brings a new solution to the market: a compact and highly instrumented growth chamber. “It’s an experimental chamber rather than a farming chamber. Therefore, you won’t use it to grow vegetables, but you can use it to identify which growing parameters are best suited to your crops,” Alexis says.

The Grobotic Systems team outside their workshop in Sheffield, England. From left to right: Dr Alexis Moschopoulos, Richard Banks, Andrew Merson, and Gareth Coleman. Credit: UKRI.

On your desk or under your bench

According to Alexis, the chamber fits on your desk or under your bench. It can apply any environmental condition preferred, including light spectra and temperature. Internet connection via the growth chambers allows users to monitor plants on their cellphones via integrated cameras and other sensors inside the chamber.

Another advantage of the chambers’ size is that they can be stacked in an array, adjusting variables in each chamber. In this way, a multi-variable experiment can help users identify which environment works most optimally for their intended crop. “When using a large cultivation room, it is hard to split the room into different temperatures. A smaller cultivation space, such as our growth chambers, can be placed anywhere, just like a personal computer. Moving away from the large expensive capital equipment and machinery to small and stackable experimental chambers saves a lot of space and money.”

Alexis first came up with the concept of the growth chamber during his PhD and postdoctoral work in plant genetics. Several prototypes are currently being used at research institutes and start-up companies. Grobotic Systems is working on a more advanced growth chamber that will be launched in the summer of 2021: “We are integrating feedback from the deployed prototypes into the design of the advanced chamber, and we will start marketing the advanced chamber later this year.”

Richard Banks designs a control system circuit board for an early prototype Grobotic chamber. Credit: UKRI.

Large-scale farms

Not only new farmers can benefit from running small-scale experiments in a growth chamber, but also large-scale, established farms, since the chamber allows them to experiment with new varieties, creating the optimal yield. This will in turn enable them to upscale their production. “Not all farmers like to invest their time in carrying out experiments, as some trust that the vertical farming technologies they buy will always work for them. However, in the end it could save them a lot of money. No one needs to use productive farm space to do the experiments, just a few manageable boxes can suffice.”

Gareth Coleman works on the chamber imaging and control systems. Credit: UKRI.

For more information:

Grobotic Systems

Dr Alexis Moschopoulos, Managing Director alexis@groboticsystems.com

www.groboticsystems.com

Author: Rebekka Boekhout

© VerticalFarmDaily.com

Columbia Vertical Farm Uses Technology To Cut Plastic Pollution And Boost Sustainability

The new packaging comes at no extra cost to the customer and will be cheaper in the long-run for Vertical Roots

Vertical Roots is the largest hydroponic container farm in the country. They grow and package lettuce varieties and have recently implemented a packaging process that reduces plastic with a resealable film. TRACY GLANTZ TGLANTZ@THESTATE.COM

With the use of agricultural technology, Vertical Roots farm in West Columbia created a packaging system for its leafy greens that cut down the company’s plastic usage by 30% and extends the shelf life of the lettuce.

In 2015, high school friends Andrew Hare and Matt Daniels created the idea for Vertical Roots, now the largest hydroponic container farm in the country. Hare is the general manager of the company and Daniels acts as the chief horticulturist.

The first Vertical Roots opened in Charleston and expanded with its second farm site in West Columbia in 2019. Vertical Roots parent company, AmplifiedAg, manufactures the container farms and farm technology of which Vertical Roots operates.

The farms are part of a growing industry called controlled environmental agriculture (CEA) that uses technology to ramp up nutrient-rich food production year around.

Hydroponics helps the farm uses 98% less water than traditional farming, according to Hare. Their technology creates an indoor environment to grow lettuce on the East Coast. Most lettuce in the U.S. comes from California and Arizona, where temperatures do not fluctuate much throughout the year, travelling 2,000 miles from farm to table. Vertical Roots offers a solution for local lettuce.

“Our mission is to revolutionize the way communities grow, distribute and consume food,” said Hare. As populations grow, Hare said the ability to produce enough food is a global concern.

VERTICAL ROOTS AGRICULTURAL INNOVATION

As a company committed to sustainability, Vertical Roots had to address its plastic usage and the consumer demand for environmentally friendly products.

“I think everyone can agree that the amount of plastic that’s consumed and used globally is a bit of a problem,” said Hare.

If Vertical Roots were to completely opt-out of using plastics, as much as 40% of the lettuce would be damaged in transportation to the retailers, Hare said. So the company decided to still use plastic containers in order to cut out food waste, but it changed the amount and type of plastic used.

By replacing the conventional “clamshell” plastic lids that you see on a container of lettuce at the grocery store, Vertical Roots cut down more than 30% of plastic usage by creating a resealable film lid. The new packaging comes at no extra cost to the customer and will be cheaper in the long-run for Vertical Roots, according to Hare.

The farm also uses recycled plastic that can also be recycled again after use. Tiny perforations in the film lid of the packaging allow air to leave the lettuce container and extends the product’s freshness, making Vertical Roots lettuce last around 14 days on the shelf.

“We tested respiration and condensation with each lettuce variety, and ultimately found that we could extend the freshness and shelf life of our salad mixes even more,” said Hare.

Vertical Roots, at the S.C. Farmer’s Market, is the largest hydroponic container farm in the country. They grow and package lettuce varieties. Tracy Glantz TGLANTZ@THESTATE.COM

GROWTH IN THE AGRICULTURAL TECHNOLOGY INDUSTRY

In the first three quarters of 2020, a record $754 million of venture capital was invested in the vertical farming industry, according to PitchBook data. This was a 34% increase from the entire previous year, Bloomberg reported in a January article.

A 2019 report from Global Market Insights showed that the vertical farming market size, or the number of potential customers or unit sales, surpassed $3 billion in 2018 and said it, “will exhibit a massive compound annual growth rate (CAGR) of over 27% from 2019 to 2026.”

In vertical farms, crops are harvested on several vertical layers indoors, where farmers can grow year-round by controlling light, temperature, water and other factors, according to the U.S. Department of Agriculture.

Vertical agriculture is also seen as a growing industry because it “could help increase food production and expand agricultural operations as the world’s population is projected to exceed 9 billion by 2050,” according to the USDA.

However, some are skeptical about the future of vertical farming for several reasons. The farms use LED light bulbs to grow crops, which require a lot of energy and money to operate.

Also, the farms mostly produce greens, which are low in calories because they take less water and light. The new farming technology is marketed as a way to combat world hunger, but in poorer countries, low-calorie greens are not as beneficial, according to Bloomberg.

THE FUTURE OF VERTICAL ROOTS

Despite a tough year due to COVID-19, Vertical Roots will open two more indoor, container farms in Georgia and Florida in 2021.

The company lost revenue from foodservice customers like restaurants, schools and universities during the pandemic, said Hare.

Those food service customers accounted for about half of Vertical Roots’ business, Hare said. Grocery store business stayed steady and even grew during the pandemic. As schools and restaurants are slowly reopening, Vertical Roots is gaining business back.

The West Columbia farm location produces about $1.5 million pounds of produce per year, said Hare. Vertical Roots lettuce is in 1,200 different grocery stores in 11 states, including Lowes Foods stores, Publix, Harris Teeter and Whole Foods Market chains.

Hare said the company is constantly working on sustainable initiatives, including figuring out a way to reduce light energy consumption by 20-25%, thinking about compostable packaging systems and finding ways to use less water at the farms.

In the future, Vertical Roots hopes to offer a larger variety of produce. The team is experimenting with growing foods like tomatoes, cucumbers, peppers, herbs and mushrooms to see if they could be viable products.

At 25,000 square feet, the world's first indoor vertical farm is also one of the largest farms. Located 120 miles south of Seoul, South Korea, fruits and vegetables grow without soil, bathed in light from pink LEDs. BY META VIERS

1 of 3

Vertical Roots, at the S.C. Farmer’s Market, is the largest hydroponic container farm in the country. They grow and package lettuce varieties. TRACY GLANTZ TGLANTZ@THESTATE.COM

“Sharing Technology Is The Only Way The Industry Will Grow”

Lack of this might lead to farmers being susceptible to misleading information, using ineffective technologies, which I’ve seen many people suffering from.

“There is a lack of know-how amongst farmers to apply those techniques in a successful way,” says Joe Swartz, Vice president and Lead horticulturalists at AmHydro. In every situation, according to Joe, from geography to the skill of the grower or climate control, all play into what types of technology should be used. This requires a lot of experience and knowledge. Lack of this might lead to farmers being susceptible to misleading information, using ineffective technologies, which I’ve seen many people suffering from.

Joe adds, “Watching many good growers that have been led down a bad path in the industry, while investing so much into technologies that are not really effective, really breaks my heart. While providers know that they aren’t effective in this particular situation. With many years of industry experience, Joe is well aware of the challenges that the industry faces these days. Within the aquaponics sector there is not one singular technology, just as in conventional farming, rather various unique technologies can be combined for different outcomes.

Lack of know-how